[vc_row][vc_column][vc_column_text css=”.vc_custom_1634759360442{margin-bottom: 0px !important;}”]

The Recording of the Elliott Wave Plus Quarterly Premium Plan Webinar

October 19, 2021

Another quarter has gone by, which means it’s time for Elliott Wave Plus to reoptimize our proprietary algos to the most current 3-year backtest results. In this blog, you will see the everything our Premium Plan subscribers have access to on a nightly basis. The webinar was two hours long. During the entire second hour, there was a vigorous and extensive question and answer session, where Sid showed a number of current Elliott Wave counts by request, and explained in detail how he incorporates Hurst cycle analysis in his wave counts.

The Premium Plan consists of:

- Nightly screenshots on over 20 trading instruments (stock index futures, commodities, currencies, bonds, etc.), showing the most recent momentum buy/sell signals, change stop to trailing indicators, and/or exit trade suggestions. Please visit ElliottWavePlus.com to see the full list of items covered.

- Sentiment positioning on all items that contain sentiment data.

- A nightly summary report including algo signals, sentiment conditions, Sid’s Elliott wave roadmap, and Hurst Cycle analysis on twenty items.

- A nightly email letting subscribers know that today’s signals are available to view and download.

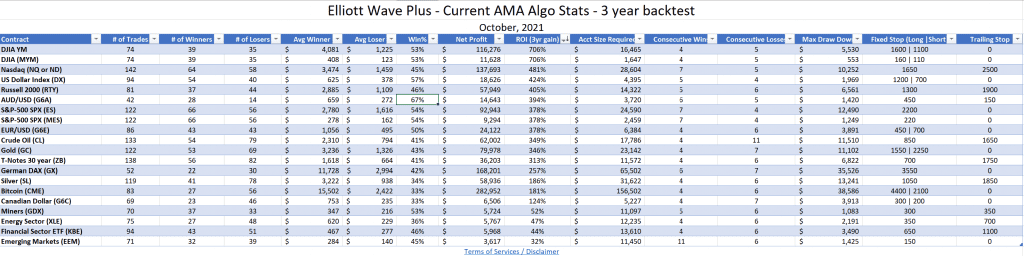

You’ll also be able to download a sortable excel spreadsheet showing the most recent 3-year backtest results. This sortable chart shows everything!

Sortable Spreadsheet:

- Total number of trades in the last 3 years.

- Number of winning trades, and number of losing trades.

- Average winning trade, and average losing trade.

- Win percentage.

- ROI (3 year gain).

- Account size required to start.

- Max closed out draw down during the 3-year backtest.

- And more…

Some items on the have produced amazing results. See for yourself!

Click the link below to download and view the excel sheet:

Elliott Wave Plus, current AMA algo stats – Sortable Spreadsheet free download

Quarterly Premium Plan Webinar Recording:

Finally, here’s a complimentary video where Sid goes into great detail on the Premium Plan Nightly Report algos, and why they continue to do well. There’s a ton of useful information in this video, so check it out! If you enjoy it, please ‘like’ it and subscribe to our YouTube channel. We provide video sneak peaks of Sid’s Elliott Wave counts from time to time. If you’re new to Elliott Wave and want to access an excellent tutorial for free, click here.

Thank you!

– Sid Norris & Andrew Norris

Subscriptions:

We offer a number of subscription levels. Some are mostly about future roadmaps based on a combination of Elliott Wave and Hurst Cycles, and others are based on automated algos. Sid presents his Elliott wave counts, which include integrated Hurst cycle analysis on over one hundred trade-able items for subscribers (Basic Plan & up) every weekend. He sends out updates on the most popular of those items every Wednesday. Crypto and Premium Plan subscribers receive algo screenshots nightly, as described in prior blog posts. Sid’s unique approach is well worth considering, especially if you’ve never experienced wave labeling and associated Fibonacci price targets that are derived in harmony with independent Hurst cycle analysis. Here’s more info about subscribing.

Be sure to subscribe at our YouTube channel.

Follow us on Twitter

Follow us on Facebook

(There is risk of loss in all trading. See the full disclaimer at our site.)

Testimonials:

“Sid, you continue to yield remarkable results – your silver analysis has been nothing short of spectacular this year and I have made enormous profits this year thanks to it. Booked another huge silver profit ( this time short ) based on your perfect analysis. God has blessed you my friend with great wisdom- thanks for sharing it with others !” – J.F

“Sid, Just a quick note from a long-term subscriber to let you know how much I appreciate your work, insight and dedication to excellence. Thank you and regards.” – J.V

Click here for many more testimonials spanning the last ten plus years.[/vc_column_text][/vc_column][/vc_row]