Accurate Predictive Technical Analysis

Video Recording and Bonus Screenshots

Elliott Wave Plus

Predictive Technical Analysis Using Elliott Wave and Hurst Cycles

Are you tired of incorrect or wishy-washy market forecasts? You’ll probably enjoy seeing how accurate Sid’s analysis has been over the past few months. We’ll show you a video clip and several screenshots from previous live webinars, where Sid made bold predictions based on his unique technical analysis of the Dow Jones Industrial Average and S&P-500. In addition, we’ll include some bonus screenshots of Elliott Wave Plus’s automated momentum trade signals. Our services have been providing subscribers with timely and accurate technical analysis, and our inbox has been flooding with grateful testimonials. We truly believe that Elliott Wave Plus continues to provide subscribers with WAY more useful trading information than any competing Elliott Wave centered service. Check out what Elliott Wave Plus has to offer.

S&P-500 and Dow Jones Industrial Average

During the June 12 webinar, Sid predicted that the bottom was nearly in. The clip from the June 19 webinar confirms his Elliott Wave and Hurst Cycle analysis was correct. The market then followed Sid’s Elliott Wave counts through the mid-August peak, and Sid’s forward roadmap has remained quite accurate after that as well.

Sid’s Elliott Wave roadmap in mid-June was as follows:

The March 2020 low ended black (intermediate) degree wave 4. Within black wave five to the upside, minor degree wave 3 (blue) ended November 22, 2021, and blue wave 4 ended June 17, 2022. Blue wave 5 to the upside is next.

Hurst Cycle analysis read as follows:

Projecting upward movement from mid-June 2022 through early January 2023. Does this mean that we will see only upward movement for the next 6 months? Most definitely not. The market doesn’t move in a straight line. But this Hurst analysis, in conjunction with Elliott Wave gave traders a strong indication that buying the stock market at that exact juncture in mid-June was worthy of strong consideration, despite historic negative sentiment.

Then, toward the end of the video clip, you will also see Sid’s coverage from his August 14 weekly “Counts” webinar, which shows that Sid’s Elliott wave count, supported by his preferred Hurst cycle analysis and several additional proprietary indicators predicted that an interim peak was imminent. The market peaked two calendar days later, on August 16. So, his roadmap was, once again right on the money.

Elliott Wave Plus – Video Covering S&P-500 and DJIA

Keep in mind, the future Elliott Wave roadmaps you see on older screenshots does not necessarily reflect Sid’s exact short-term wave counts today. Both Elliott Wave and Hurst Cycle Analysis adjust to ongoing price action, so keeping abreast of Sid’s continually updated roadmaps is critical to subscribers continued success. Our communications with subscribers, depending on the subscription level, includes Elliott wave main and alternate counts and associated Fibonacci price targets, projected Hurst cycle turn dates, sentiment conditions (including our proprietary Commercials vs. Retail screenshots), daily and weekly trend direction, as well as algorithmic momentum trade signals. Our subscribers stay well informed. We put the time and energy into detailed technical analysis, so you don’t have to.

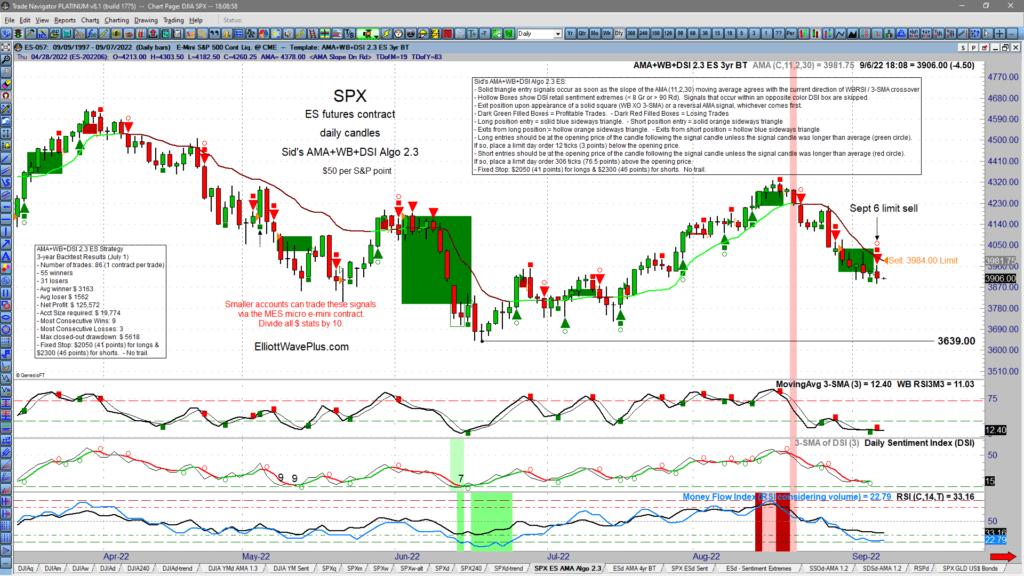

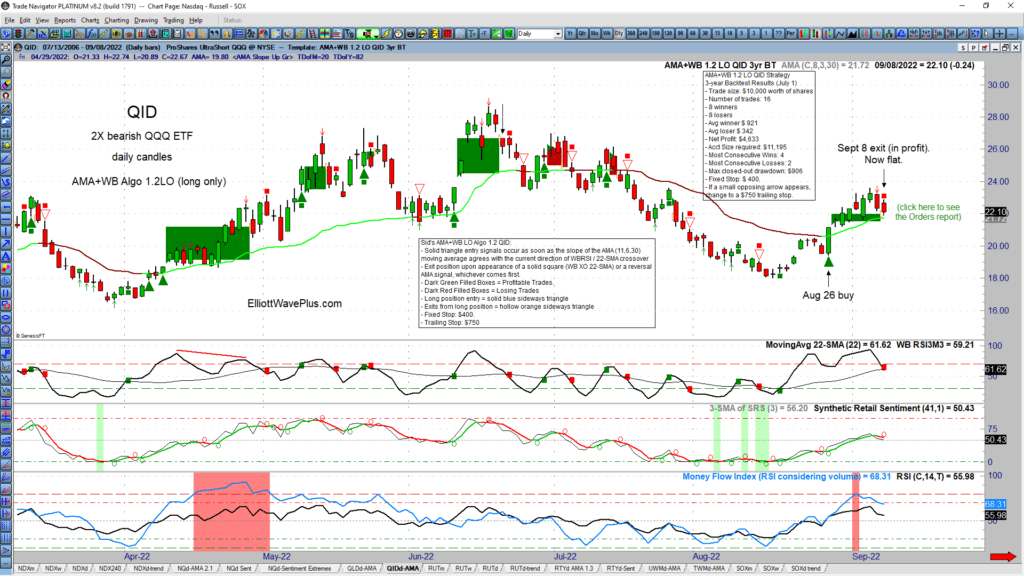

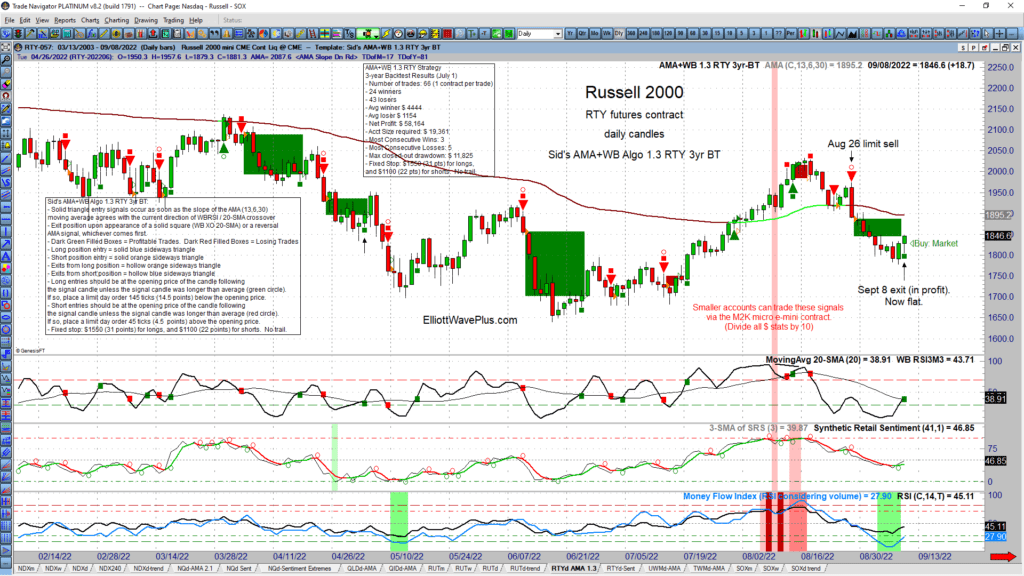

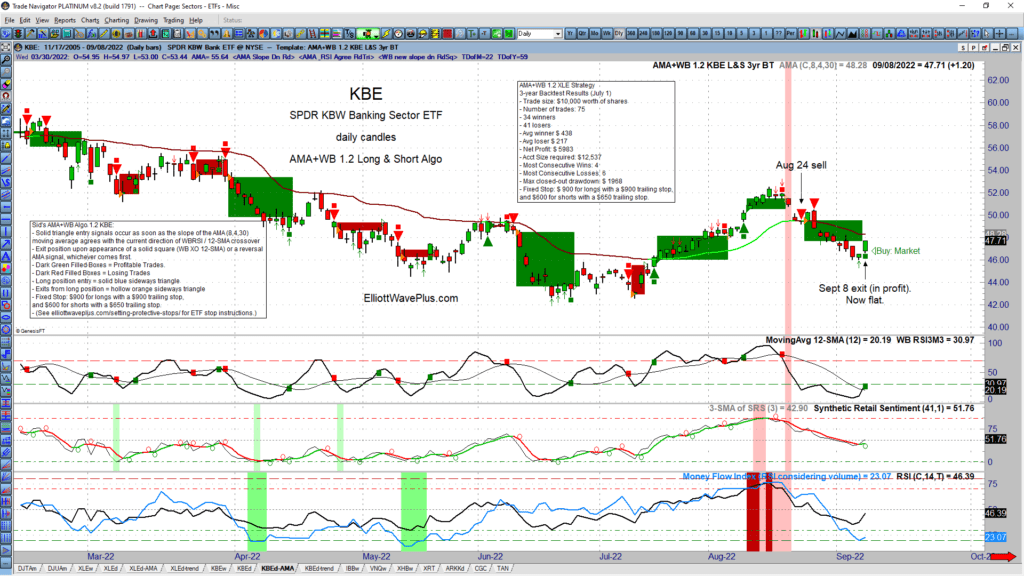

Automated Algo Trade Signals

It’s quite common for traders to focus on only one trading instrument, stock, sector, or currency when trading. Our Nightly Algo Report was created to expand subscribers trading horizons, eliminating tunnel vision by providing easy tracking of multiple trading instruments. Subscribers and therefore choose which instrument is at an optimum juncture to trade RIGHT NOW. Here’s a few screenshots of our Algo’s profitable closed out trades this past week. The large green blocks represent winning trades, and the smaller dark red block represent losing trades:

S&P-500 (SPX ES – AMA Algo)

Nasdaq (QID levereged ETF)

Russell 2000 (RTY)

Financial Sector (KBE)

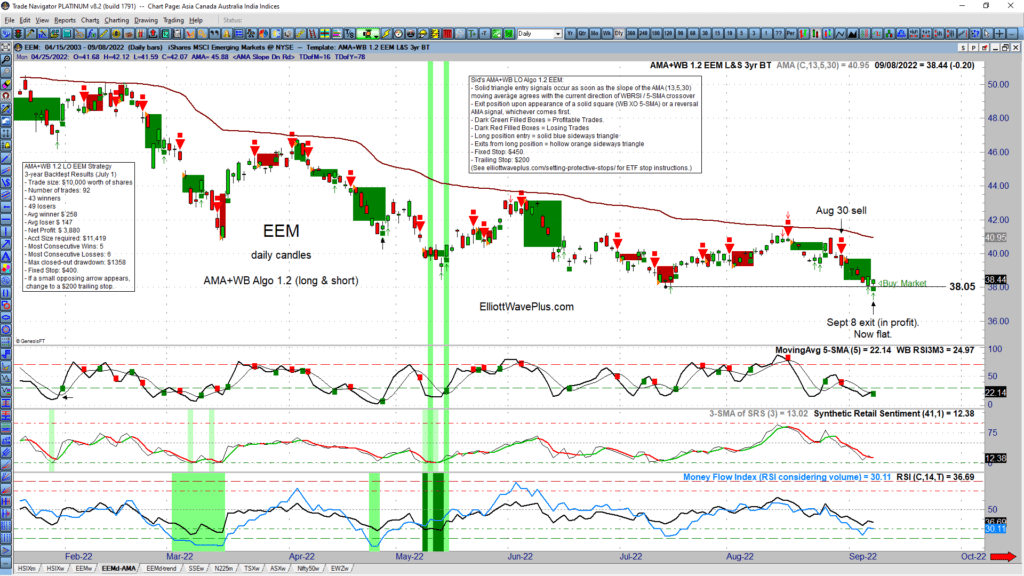

Emerging Markets ETF (EEM)

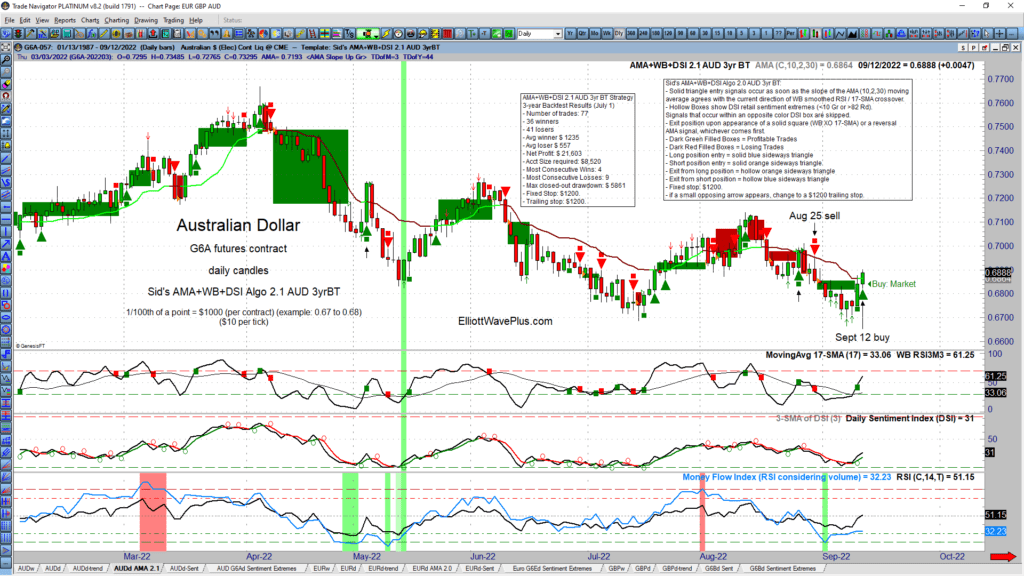

Currencies (AUD/USD)

Sentiment conditions screenshots compliment our AMA Algo screenshots. If you missed our blog post about how valuable our sentiment screenshots are, click the following link:

All About our Improved Nightly “Sentiment Conditions” Screenshots – from Elliott Wave Plus

Whether it be the U.S stock market, bonds, mining stocks, the energy sector, industrial metals, currencies, crypto & more, Elliott Wave Plus provides expert technical for traders and investors across the board.

If you have an interest in a subscription or have any questions, email [email protected].

– Sid Norris & Andrew Norris

SUBSCRIPTIONS:

We offer four subscription levels. The Premium Plan includes everything we do including daily momentum algo trade signals on over twenty items, as well as daily screenshots of our proprietary Sentiment Conditions template. The Pro and Premium plans include future roadmaps based on a combination of Elliott Wave and Hurst Cycles, as well as a “live” weekly Counts webinar. The entry level Trend Plan offers daily trend analysis (but no Elliott Wave or Hurst) on many popular items, plus momentum algo signals on Cryptos.

Sid’s unique approach is well worth consideration, especially if you’ve never experienced wave labeling and associated Fibonacci price targets that are derived in harmony with independent Hurst cycle analysis. Here’s more info about subscribing.

Be sure to subscribe at our YouTube channel.

Follow us on Twitter

Follow us on Facebook

(There is risk of loss in all trading. See the full disclaimer at our site.)

TESTIMONIALS:

“Sid, you continue to yield remarkable results – your silver analysis has been nothing short of spectacular this year and I have made enormous profits this year thanks to it. Booked another huge silver profit ( this time short ) based on your perfect analysis. God has blessed you my friend with great wisdom- thanks for sharing it with others !” – J.F

“Sid, Just a quick note from a long-term subscriber to let you know how much I appreciate your work, insight and dedication to excellence. Thank you and regards.” – J.V

Click here for many more testimonials spanning the last ten plus years.

Thanks for reading!