The Two Questions on Every Investor’s Mind.

Are Interest Rates Topping? Has Inflation Peaked?

The following video clip from our April 10, 2022 Weekly Counts Webinar provides timely food for thought on those two questions. Possible conclusions are based on Elliott wave theory and its associated Fibonacci price targets, a multi-decade trendline (on a semilog chart), and current sentiment conditions.

Rising Interest Rates and Inflation are all over the news. Conventional expectations of directional market reactions to news have consistently been wrong. Investors are confused and worried. It’s time to get technical.

Technical analysis helps eliminate the worry and confusion. It ignores mainstream financial media and their ridiculous news-based explanations of why the market moves up and down. Elliott Wave theory, Cycle analysis and Sentiment Conditions are more important to traders and investors now than ever before.

The attached video clip was recorded on Sunday, April 12, and was a small portion of Sid’s Weekly Counts Webinar for ElliottWavePlus.com subscribers (Pro Plan and up).

In the video, Sid Norris examines TNX (bond yields), and TIP (Treasury Inflation Protection bonds). Are rates going to continue to skyrocket unabated? Is the aggressive inflationary period over?

Video

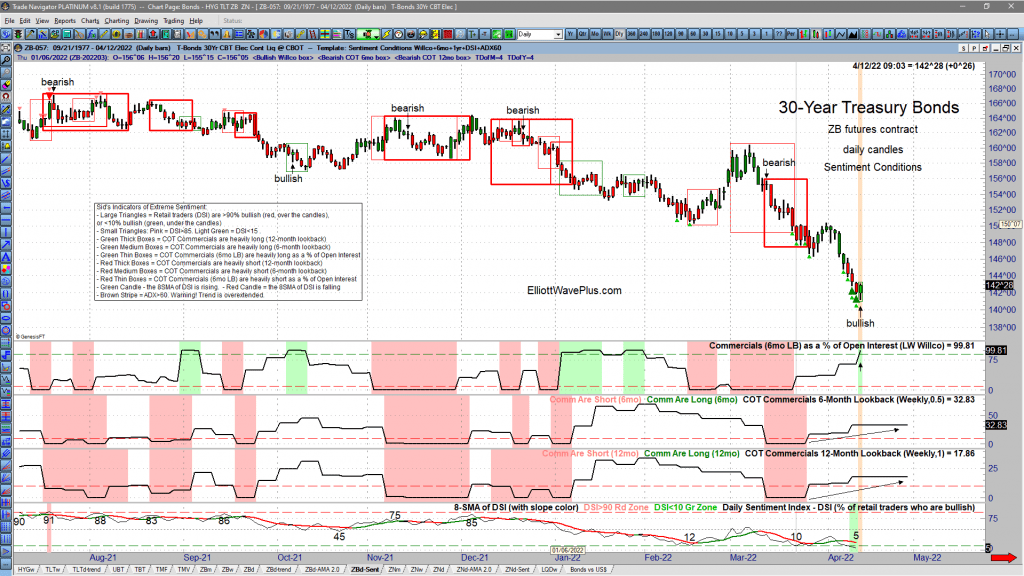

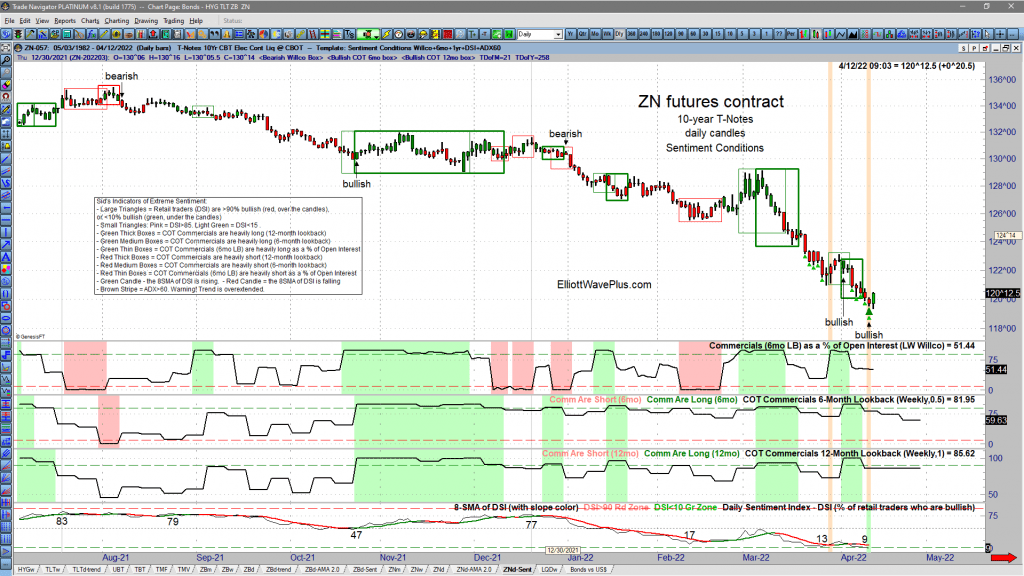

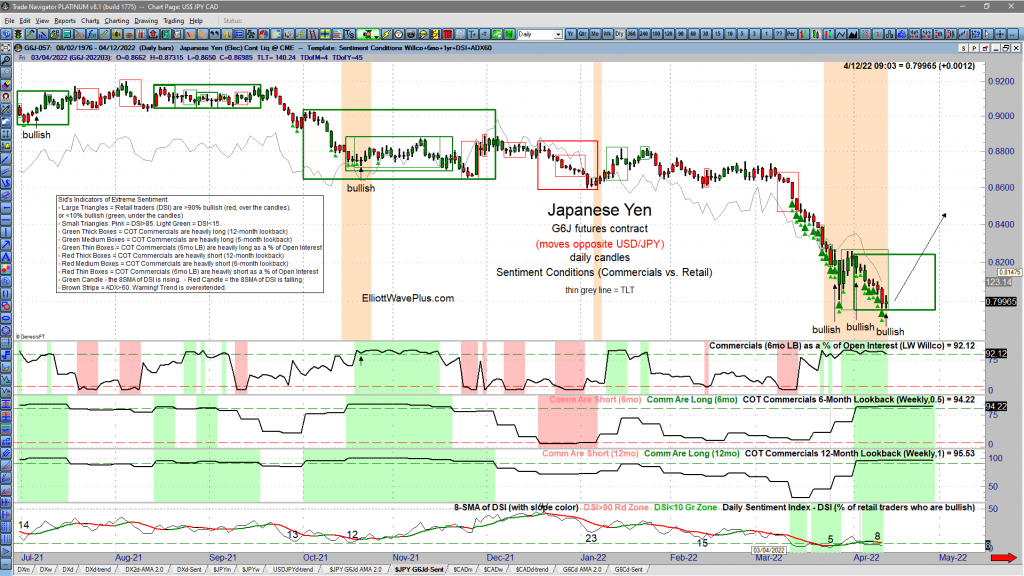

Additional evidence of Sentiment extremes in bonds were presented later in the webinar. Here are current screenshots of current Sentiment Conditions in the ZB contract (30yr bonds), the ZN contract (10yr bonds), and the Japanese Yen, which is historically highly correlated with bonds. These screenshots show that Commercials are expecting rates to top about now (and bonds bottom), while retail traders, who are almost always wrongly positioned at major trend changes, think that rates will continue to aggressively rise. Premium Plan subscribers receive Sentiment Conditions screenshots on many tradable items nightly.

ZB contract (30-year bonds) Sentiment Conditions:

ZN contract (10-year bonds) Sentiment Conditions:

Japanese Yen Sentiment Conditions:

We will post an educational video soon that explains how to interpret these Sentiment Conditions screenshots. They’re incredibly usefull!

THE BOTTOM LINE:

Here at Elliott Wave Plus, we combine Hurst cycle analysis and Elliott wave theory and its associated Fibonacci price targets to create future price movement roadmaps on many popular tradeable indices, stocks, and ETFs. Please consider a subscription.

– Sid Norris & Andrew Norris

SUBSCRIPTIONS:

We offer four subscription levels. The Premium Plan includes everything we do including daily momentum algo trade signals on over twenty items, as well as daily screenshots of our proprietary Sentiment Conditions template. The Pro and Premium plans include future roadmaps based on a combination of Elliott Wave and Hurst Cycles, as well as a “live” weekly Counts webinar. The entry level Trend Plan offers daily trend analysis (but no Elliott Wave or Hurst) on many popular items, plus momentum algo signals on Cryptos.

Sid’s unique approach is well worth consideration, especially if you’ve never experienced wave labeling and associated Fibonacci price targets that are derived in harmony with independent Hurst cycle analysis. Here’s more info about subscribing.

Be sure to subscribe at our YouTube channel.

Follow us on Twitter

Follow us on Facebook

(There is risk of loss in all trading. See the full disclaimer at our site.)

TESTIMONIALS:

“Sid, you continue to yield remarkable results – your silver analysis has been nothing short of spectacular this year and I have made enormous profits this year thanks to it. Booked another huge silver profit ( this time short ) based on your perfect analysis. God has blessed you my friend with great wisdom- thanks for sharing it with others !” – J.F

“Sid, Just a quick note from a long-term subscriber to let you know how much I appreciate your work, insight and dedication to excellence. Thank you and regards.” – J.V

Click here for many more testimonials spanning the last ten plus years.

Thanks for reading!