Carnage in the Currency Markets – Is It Over Yet?

The recent “trade war” continues to show itself in numerous unusually aggressive price movements in the currency markets. Huge, fast movements in currencies profoundly affects all markets, but most of all commodities. Trader sentiment hits rare extremes, and quite simply, there is blood in the streets. Lets take a peak at just a few currencies to see if there are any technical reasons that suggest an end to the recent carnage.

First, let’s check in on the central bank most likely to have been causing the carnage in the markets, the People’s Bank of China. It’s obvious on the chart below that the Chinese Central Bank has been aggressively manipulating the Yuan against the US Dollar since mid-June. By weakening the Yuan, they have, at least in the very short term, effectively offset any pain they might feel from the tariffs.

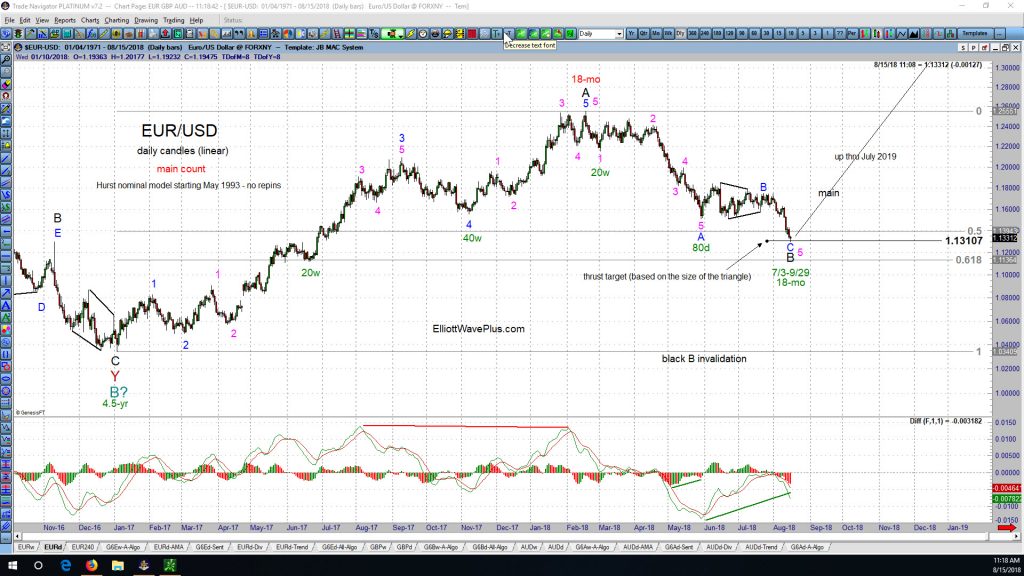

However, at least in the short term, the EUR/USD currently pair may have just bottomed. Why? Because the down-thrust from the recent triangle has hit a target based on the size of the recent triangle, and an 18-month Hurst cycle trough is expected about now.

Also worth considering is a long-term Hurst analysis of the US Dollar Index, which suggests that a significant, large cycle top is imminent:

Summary:

Technical analysis suggest that recent trends in the currency markets are just about to reverse.

Sid Norris – ElliottWavePlus.com