Charting the Effects of the Trade War

The recent “trade war” appears to have triggered several aggressive price movements in the financial markets. The most obvious reactions are in tariffed commodities like soybeans and lean hogs. But, there are other recent price movements, specifically in the currency market that appear most likely to have been caused by direct government and/or central bank intervention. These currency interventions have affected, at least in the short term, the pricing in numerous commodities, some substantially more than others.

Let’s look at the likely date of one of the recent central bank interventions and compare price movements of multiple currencies to determine the likely source of the intervention. Then, we’ll examine the effects of the intervention on some commodities and compare the reactions.

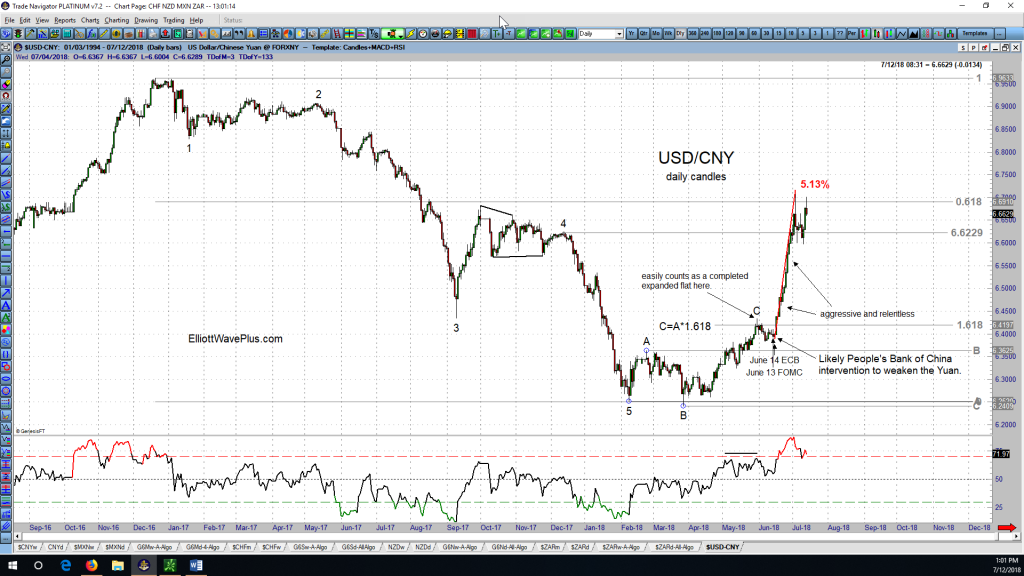

Here’s a daily chart of the US Dollar / Chinese Yuan currency pair:

Notice the aggressive and relentless upward movement starting June 14, which happened to be the date of the most recent Mario Draghi ECB announcement. That announcement contained no surprises whatsoever. The ECB stated that their intention moving forward was to keep rates the same for now but discontinue QE. Normally, such an announcement should have been Euro positive, as less Euros would be printed moving forward, therefore ending the recent period of devaluation. What a perfect date for the People’s Bank of China to intervene! Traders and financial news organizations would mistake the move as a reaction to the ECB news release.

Compare how aggressive the move was in the Yuan (5.13%) to the move in the Euro (2.9%):

Now, here’s a chart of Copper, showing the drastic reaction (a 16.5% drop) to the June 14 PBOC Yuan intervention:

However, the reaction in Crude Oil was only a 5.32% drop:

History shows that movements due to central bank interventions into currencies are unsustainable. For example, the Bank of Japan obviously intervened to weaken the Yen starting the night of the US presidential election, November 9, 2016. The unnaturally relentless upward movement in the USD/JPY currency pair lasted 26 trading days and hasn’t reached the level of the resulting December 16, 2016 high ever since:

Summary:

Based simply on the price action, the People’s Bank of China likely intervened to weaken their currency on June 14, 2018. It also appears that the intervention affected the price of copper more than other commodities. However, central bank interventions into the currency markets have historically been unable to kick off new sustainable trends.

Sid Norris – ElliottWavePlus.com