A Perfect Storm of Sentiment Conditions

Softs (Cocoa, Coffee, Sugar)

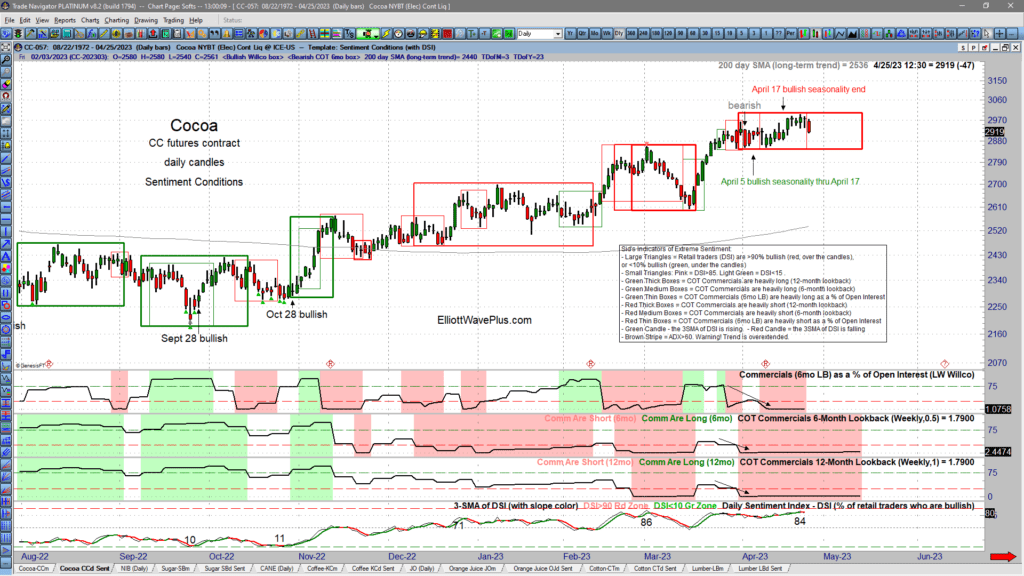

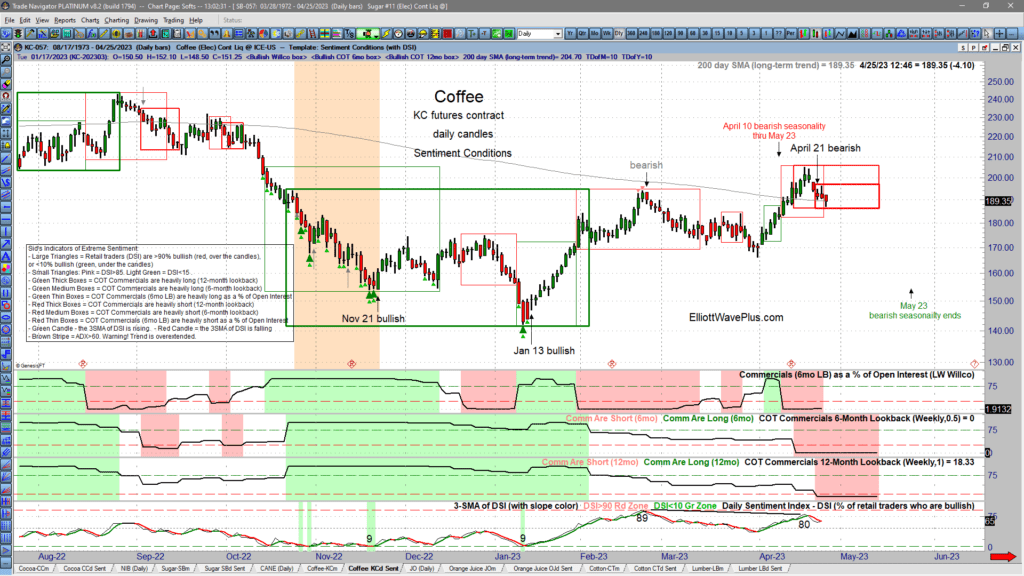

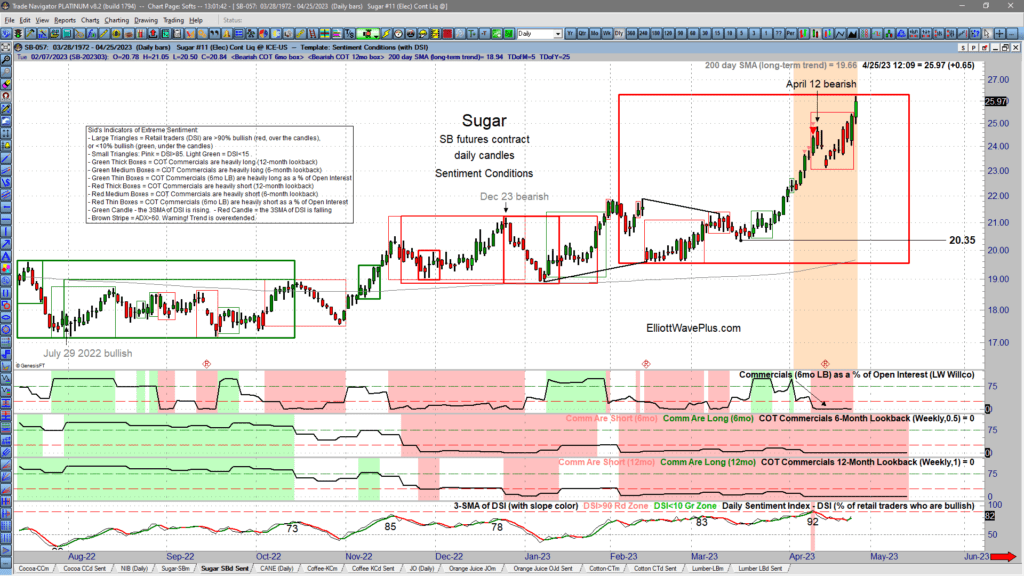

Charts brought to you by Elliott Wave Plus

Elliott Wave Plus – (A Brief Statement)

Please don’t confuse us with our competition. We are dedicated to providing the finest technical analysis available by utilizing a combination of Elliott Wave, Hurst Cycles, Sentiment Conditions, and more. This is why we chose to start this new blog series called Elliott Wave Charts – Sentiment Conditions. If you are new to ElliottWavePlus.com, or are unfamiliar with our services, please read through all the way to the bottom of this article. There you will find links to our free services, along with examples of the deep-dive analysis we provide to our subscribers.

Sentiment Conditions

Sentiment is the general outlook or attitude of market participants toward a particular security, or the overall financial market. Here at ElliottWavePlus.com, we pay particular attention to the spread between retail traders (trend followers/chasers) and Commercials (hedgers). Commercials are entities involved in the production, processing, or merchandising of a commodity. Commercials use futures and options on futures to HEDGE their business interests. A commercial trader might also refer to an institutional trader, which is one employed professionally by a bank, brokerage, fund, or other financial firm.

What do we mean by a “Perfect Storm”?

Our proprietary Sentiment Conditions screenshots track the positioning of Retail vs. Commercials. Commercials typically “fade” trends. In other words, they gradually build positions against a trend, knowing that there will eventually be a trend change. This is how they “hedge”. For example, Copper mining companies will gradually build a position against an uptrend in Copper because they want their futures trading account to protect the company against the inevitable coming downtrend. Then, during the next downtrend, they will gradually remove their hedges. At the end of both uptrends and downtrends, Commercials are typically correctly positioned to take advantage of the inevitable trend change. In other words, after long uptrends, Commercials are typically heavily short, and after long downtrends, Commercials are typically heavily long. When they are heavily short, there’s a lot of pink or red on our Sentiment Conditions charts indicating that the situation is bearish. When they are heavily long, there’s a lot of green on the chart indicating that the situation is bullish.

As for retail traders, they typically build positions WITH a trend. Typically, by the end of an aggressive uptrend, retail traders are generally “all in” long. Conversely, by the end of an aggressive downtrend, retail traders become convinced that prices will go down forever.

A “Perfect Storm” of sentiment occurs when Retail traders are positioned exactly opposite Commercial traders, and both are at extremes. We pinpoint when a perfect bullish or bearish condition exists on the nightly charts.

Current List of Nightly Sentiment Conditions Screenshots

Every night, we provide our Premium Plan subscribers access to nearly thirty Sentiment Conditions screenshots. If you’re looking for the most inclusive set of Elliott Wave Charts – Sentiment Conditions, here’s the current coverage list:

- Dow Jones Industrial Average (YM contract)

- S&P-500 (ES contract)

- Nasdaq-100 (NQ contract)

- Russel 2000 (RTY contract)

- German DAX (GX contract)

- 30-year Bonds (ZB contract)

- Crude Oil (CL contract)

- Natural Gas (NG contract)

- 30-year Bonds (ZB contract)

- Copper (HG contract)

- Platinum (PL contract)

- Gold (GC contract)

- Silver (SI contract)

- Corn (ZC contract)

- Wheat (ZW contract)

- Soybeans (ZS contract)

- US Dollar Index (DX contract)

- Canadian Dollar (6C contract

- Australian Dollar (6A contract)

- Euro (6E contract)

- Cocoa (CC contract)

- Coffee (KC contract)

- Sugar (SB contract)

- Cotton (CT contract)

- Lean Hogs (LE contract)

- Live Cattle (LE contract)

- Lumber (LB contract)

- Orange Juice (JO contract)

Almost all of those items have at least one ETF equivalent with associated options available.

What items are worth looking at right now?

Currently, there are several tradable items indicating a “Perfect Storm” condition, including, Gold, Silver. Live Cattle, Cocoa, Sugar, and Coffee. All of those items are currently presenting a BEARISH setup. Here are the Sentiment Conditions charts on three of those items: Cocoa, Coffee, and Sugar. Notice that if a current bullish or bearish period of seasonality exists, we also note that on all of our Sentiment Conditions screenshots. (Click on the charts to enlarge).

For more detailed information about the indicators shown on our Sentiment Conditions screenshots, check out the following video from our YouTube channel: https://www.youtube.com/watch?v=LZHT8CFrXEU

Cocoa:

Coffee:

Sugar:

Is Food Inflation Over?

As for the question of inflation, and has it run its course, there is no consistent answer. While energy has been coming down since March 2022, as you can see from the charts above, food inflation has, in several items, continued aggressive to the upside, and several, especially beef, have been in relatively consistent rallies ever since March 2020. However, our Sentiment Conditions template is showing that a “Perfect Storm” of bearishness may be forming, indicating that aggressive food inflation may be ending about now, at least for a while.

If you want more content like Elliott Wave Charts – Sentiment Conditions, consider subscribing to our Premium Plan. That way you’ll know when the next perfect storm is forming.

Subscription Details

We offer four subscription levels. The Premium Plan includes everything we do including daily momentum algo trade signals on over twenty items, as well as daily screenshots of our proprietary Sentiment Conditions template. Additional sentiment conditions are now included in this plan. The Pro and Premium plans include future roadmaps based on a combination of Elliott Wave and Hurst Cycles, as well as a “live” weekly Counts webinar. The Basic Plan includes the Elliott wave + Hurst cycles screenshots only (twice-per-week), but no weekly webinar. The entry level Trend Plan offers daily trend analysis (but no Elliott Wave or Hurst) on many popular items, plus momentum algo signals on Cryptos.

Our unique approach is well worth consideration, especially if you’ve never experienced wave labeling and associated Fibonacci price targets that are derived in harmony with independent Hurst cycle analysis. Here’s more info about subscribing.

An overview of our pricing can be found here.

Be sure to subscribe at our YouTube channel.

Follow us on Twitter

Follow us on Facebook

(There is risk of loss in all trading. See the full disclaimer at our site.)

TESTIMONIALS:

“Hi Sid…I’ve been looking for an excuse for a while to pay you a well-deserved compliment. I find your insight on the markets to be SPOT ON and continue to make good money following your expert guidance. Just recently retiring myself, I feel confident that my nest egg is safe and in the position to grow (exponentially) with your guidance. I’ve tried a lot of trading services in the past, and find you to be an exception to ALL of them in quality of material, integrity and transparency, and feel no reason to ever look elsewhere.” – K.B.

“One of the traders in my group told me she attended and loved your webinar! She has been spending time reviewing my notes and saved screen shots from previous EWP webinars and comparing them to my past trades made during the week following webinar. Her comment to me today: EWP at first glance, appears to be too good to be true. But after reviewing the successful trades you made based on EWP, it becomes even more unbelievable!” – W.H.

Click here for many more testimonials spanning the last ten plus years.