[vc_row][vc_column][vc_column_text css=”.vc_custom_1589990519058{margin-bottom: 0px !important;}”]

Elliott Wave Plus Informed Subscribers on Friday Morning of an Imminent Up Move in the Stock Market This Week

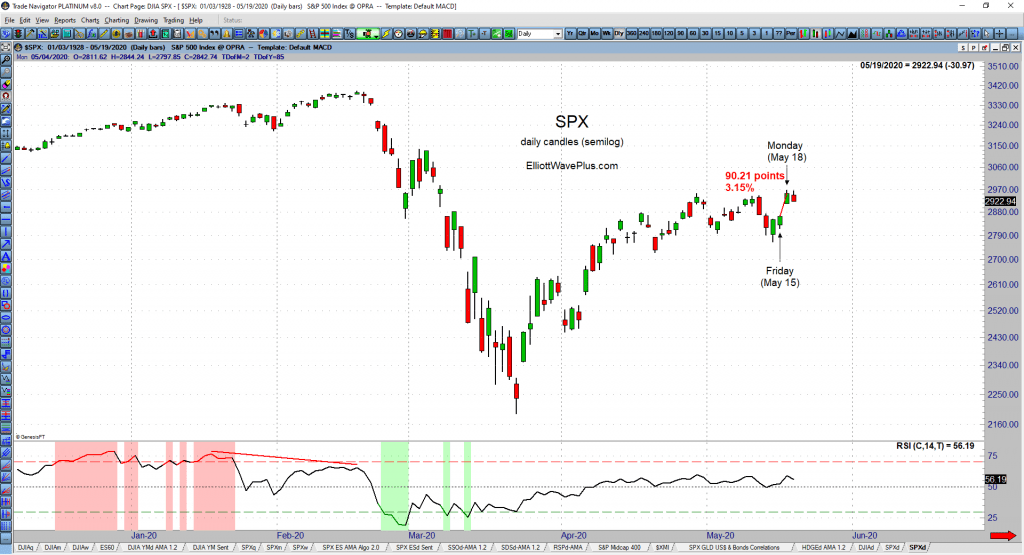

As we were headed into the weekend last week (Friday, May 15), many Elliotticians and market forecasting services were content holding on to their bearish positions regarding the stock market, and specifically the S&P-500. The Fed had previously stated that more measures were likely going to be needed to pull the economy out of its current downturn, Buffett was selling off millions of dollars of shares, and talk of major department stores filing for bankruptcy flooded the news. All of which made a very bearish outlook to almost every market forecaster . . . except from us.

During the morning hours on Friday (May 15), Sid sent out an email to everyone in the database called Sid’s Current Thoughts Regarding the S&P:

“The refusal on the part of the S&P to break lower this week, as well as the morphing of the latest Hurst Cycle Analysis of the S&P (starting 1950, no repins – see below) have eliminated the mega-bearish {2nd} alternate count (AKA mainstream EW) in my mind, and suggest a further period of sideways movement. The bounce that started yesterday {Thurday, May 14} about an hour into the day session was on high volume. Looked like coordinated institutional buying just as a strong wave 3 break lower was about to take shape, IMO. The current Hurst has now morphed a bit as a result, and IF the March low is a large cycle trough, which seems more likely to be correct by the day, Hurst is actually suggesting a bit of upward movement next week, but general continued sideways chop thru early-July next.”

Monday morning rolled around (May 18) and the futues had surged to the upside! The S&P-500 ended Monday up roughly 90 points or 3.1% in just one day. Remember those other mainstream Elliotticians who were still bearish going into the weekend? They did not warn their subscribers until AFTER the close on Monday that the market might not be as immediately bearish after all. Perhaps a costly mistake for many.

Conclusion:

Timing is everything! No system is perfect, but considering Sid’s Elliott Wave & Hurst Cycle analysis in conjunction with monitoring delta volume can help traders decide when to get in and get out. Recent volatility in the market is leaving many people wondering what’s next. Our Elliot Wave road maps and momentum-based trade signals can aid in navigating these rough waters. As always, please check out our free resources at the site.

Subscriptions:

We offer a number of subscription levels. Some are mostly about future roadmaps based on a combination of Elliott Wave and Hurst Cycles, and others are based on automated algorithmic trade signals. Sid presents his Elliott wave counts, which include integrated Hurst cycle analysis on over one hundred trade-able items for subscribers (Basic Plan & up) every weekend. He sends out updates on the most popular of those items every Wednesday. Crypto and Premium Plan subscribers receive automated trade signals nightly, as described in prior blog posts. Sid’s unique approach is well worth considering, especially if you’ve never experienced wave labeling and associated Fibonacci price targets that are derived in harmony with independent Hurst cycle analysis. Here’s more info about subscribing.

Be sure to subscribe at our YouTube channel. Look for a announcement soon regarding Sid live streaming on YouTube for subscribers at critical market junctures!

Follow us on Twitter

Follow us on Facebook

Thanks for reading.

(There is risk of loss in all trading. See the full disclaimer at our site.)

Testimonials:

“Just want to thank you creating a service that is exceptional. I trade for a living , and you are indispensable. Thanks in part to you, I had a remarkable summer of trading , booking more than $220,000 in profits since May. Keep up the great work and know that you are making a huge difference in people’s lives!” – J.F

“Hello Sid, I’ve been following every weekly webinar now about six months and I have to say that I’ve learned more than ever before in my life including also one year (several times per week) Certified Financial Analyst course and final exam. Will keep following. Thank you very much.” – J.V

Click here for many more testimonials spanning the last ten plus years.[/vc_column_text][/vc_column][/vc_row]