Have We Reached An Unsustainable Situation?

Correlations:

In the trading world, we often find relationships between two or more tradeable items. When two items are generally moving up and down together for a period of time, we consider them to be correlated. When they move opposite each other, they are inversely correlated. Some pairs of items have stronger historic correlations than others.

Examples:

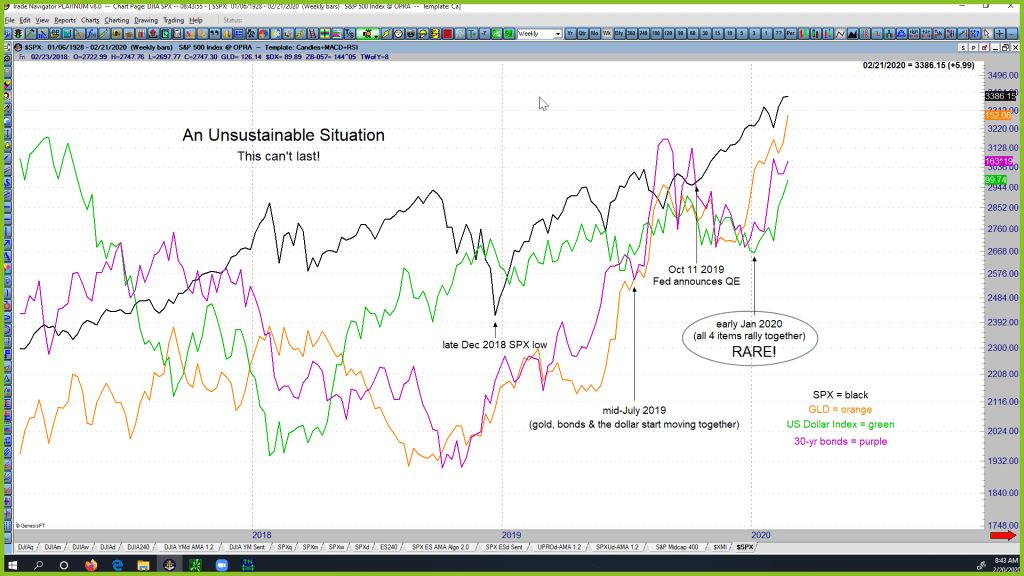

Gold & Bonds are typically correlated. As of this writing, that historic relationship appears to be intact. Compare that to Gold & the U.S dollar. Those two items typically move opposite (inverse) of each other. However, since mid-July 2019, they have generally been moving up and down together.

Bonds, which are the most popular alternative to stock ownership in the investment world, typically move opposite of the stock market. However, ever since the start of the new year (2020), stocks, bonds, gold and the US Dollar have all been rallying together. Is this a distortion that has developed because of the mid-October 2019 Fed announcement of QE? Many think so. If so however, there was a delayed reaction of 2.5 months.

Check out this chart of SPX, Gold, the U.S Dollar, and Bonds:

Conclusion:

Tight correlations of these four items moving together can rarely be found in history. Therefore, it is extremely doubtful that what we’ve been seeing since early January is sustainable. If history means anything, despite the high level of Central Bank activity in the markets currently, it would seem wise to expect a return to normal correlations at some point, likely sooner than later.

Subscriptions:

Sid presents his Elliott wave counts, which include integrated Hurst cycle analysis on over one hundred trade-able items for subscribers (Basic Plan & up) every weekend. He sends out updates on about half of those items every Wednesday. Sid’s unique approach is well worth considering, especially if you’ve never experienced wave labeling and associated Fibonacci price targets that are derived in harmony with independent cycle analysis. Here’s more info about subscribing. There are several different levels of service, including the Crypto and Premium Plans, which feature nightly momentum algo trade signal reports, as well as proprietary sentiment charts indicating current commercial vs. retail positioning.

Be sure to check out our YouTube channel.

Thanks for reading.

(There’s risk of loss in all trading. See the full disclaimer at our site.)

Testimonials:

“Elliott Wave Plus is, in my opinion, the best Elliott Wave-based market forecasting service in existence. The accuracy difference comes from Sid’s uncanny ability to properly interpret Hurst Cycle Analysis, and incorporate it into his wave counts. I’ve greatly enjoyed Sid’s advice for three years now, and his service just gets better and better! I believe Elliott Wave Plus is many times better than that other well-known Elliott Wave competitor who only utilizes Elliott Wave, but no Hurst Cycles! I personally know this because I used to subscribe to those other guys for a number of years. Sid’s weekly “Counts” webinar is the highlight of my week and he always takes time to answer all participant’s questions in an non-political, honest and understandable fashion. I’ve learned lifetime trading and investing skills from Sid.” – G.B.

“Hello Sid, I’ve been following every weekly webinar now about six months and I have to say that I’ve learned more than ever before in my life including also one year (several times per week) Certified Financial Analyst course and final exam. Will keep following. Thank you very much.” – J.V.

Click here for many more testimonials spanning the last ten plus years.