Is Gold’s Historical Correlation with the Australian Dollar and Swiss Franc Predictive?

Historical Price movement in Gold is quite similar to price action in the Australian Dollar, especially since late-2008:

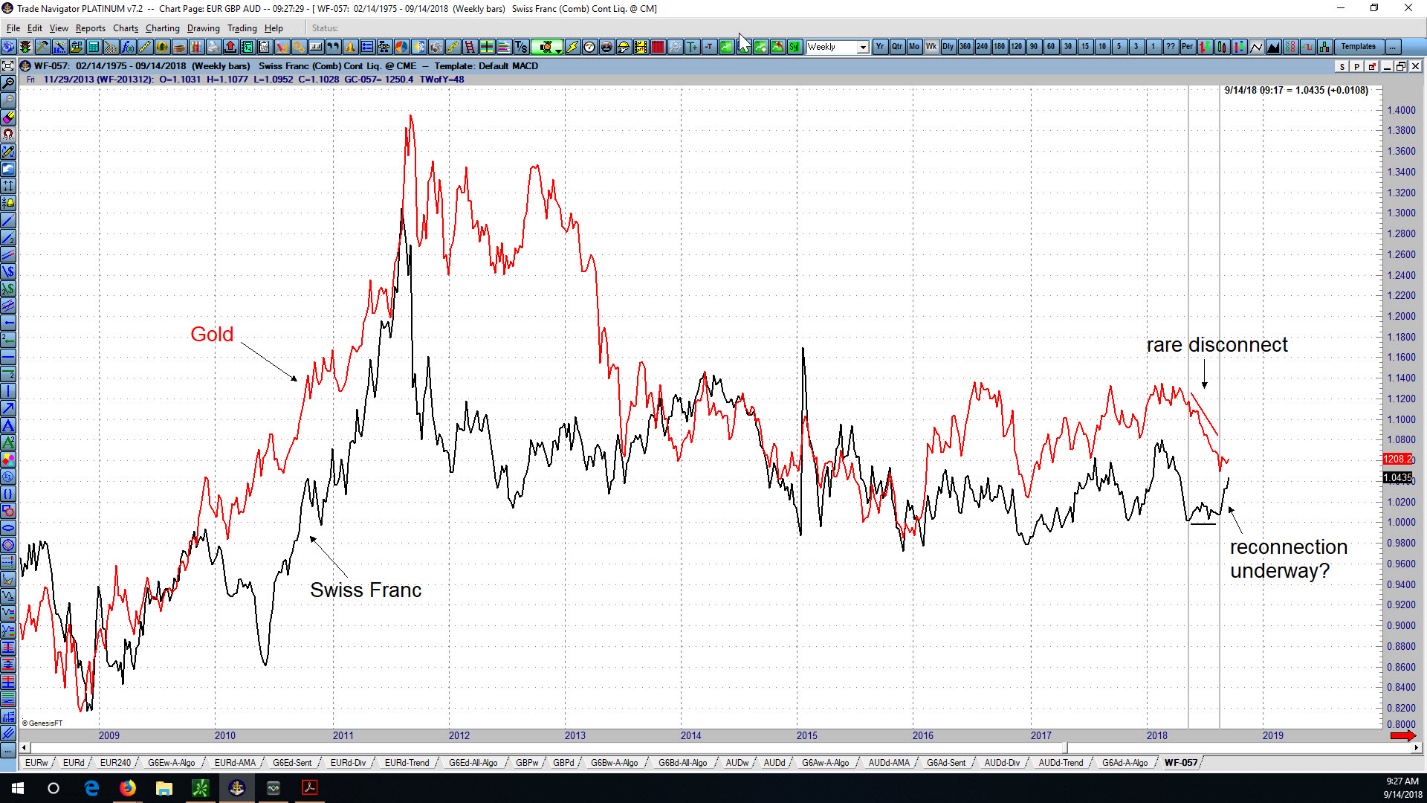

Gold is also highly correlated with the Swiss Franc, especially since mid-2013:

Recently, notice that during Gold’s April-August plunge, the Swiss Franc moved sideways. Then, in mid-August, the Swiss Franc stopped basing and started moving strongly to the upside. Gold has also moved upward since mid-August, although it has lagged the Swiss Franc in aggressiveness.

Now let’s look at the AUD/USD currency pair from an Elliott Wave and Hurst Cycles perspective, first on a weekly chart:

I’m counting the choppy, overlapping rally from January 2016 through January 2018 as a contracting leading diagonal. Diagonals are typically deeply retraced, and that’s exactly what’s happened. From January through September this year, the Aussie retraced the leading diagonal by a deep Fibonacci 78.6%. Also, the downward movement this year has clearly been corrective. Here’s my internal wave count for the downward movement this year on a daily chart:

Notice the lack of a strong third wave component within the downward movement, as well as the numerous evenly spaced overlaps all the way down.

Importantly, from a Hurst Cycles perspective, a large 18-month cycle trough is due within a date-window of mid-August through early-October. Within that window, the Sentient Trader composite line is suggesting that the recent low in mid-September is likely to be the low point of that 18-month cycle trough.

Key Points:

- Gold is traditionally highly correlated with the Swiss Franc and Australian Dollar.

- The Swiss Franc refused to move lower during Gold’s recent plunge and now appears to be leading Gold higher.

- Elliott Wave and Hurst Cycle Analysis both suggest that the mid-September low in the AUD/USD currency pair is a large cycle trough.

Conclusion:

The wind appears to have shifted and is now at Gold’s back.

Sid Norris – ElliottWavePlus.com