Setting Protective Stops – A Guide for Elliott Wave Plus Subscribers

Specific protective stop levels and stop types (fixed and/or trailing) are absolutely required and integral to my AMA/Momentum Algo trading system.

Each AMA/Momentum Algo Screenshot inside each Premium Plan or Crypto Plan Nightly Report includes an on-screen informational box that shows 3-year backtest results. Included in every one of these boxes is a suggested initial fixed stop (in dollars), as well as, on some items a suggested trailing stop (in dollars). This document is intended to spell out exactly how to determine the exact price at which protective stops orders within our system should be placed. As always, if you are a current subscriber, and have any questions about how to utilize stops within my AMA/Momentum Algo system, please feel free to email me at [email protected]

My platform, Trade Navigator does not show the suggested initial stop level on screen until the auto-entry trade is executed, which occurs at the opening price of the daily candle following the signal candle. Once the trade is active, Trade Navigator does show the initial stop on screen, but subscribers first see that level in the Nightly Algo Screenshots the evening after the entry candle is closed. This is one of the reasons why I place an informational stat box (mentioned above) on each AMA-Algo item screenshot. The information in that box includes the dollar value size of the initial fixed stop, and whether the algo suggests, based on back-testing and optimization, changing to a trailing stop at some point during the trade, and if so, the size of that trailing stop.

Futures contract example:

If the item being traded is a futures contract, the system stats are based on trading one contract at a time. Let’s use the ES contract as an example. When a new buy signal candle is initially designated, the algo is suggesting going long one ES contract at the opening price of the following candle. As of this writing, based on 3-year back-testing and optimization, the suggested initial stop for the ES contract is $1200 fixed, and no eventual change to a trailing stop is suggested. The size of the initial stop can still be ciphered very easily. When trading one contract, each ES point is worth $50. So $1200 divided by $50 is 24 points. The algo therefore suggests placing a protective stop 24 points away from the opening price of the entry candle. In this example, if the opening price of the entry candle is 2800, the algo suggests utilizing a fixed stop placed 24 ES points below that, at 2776.

Example of a typical futures contract entry and exit, when a fixed stop is utilized:

ETF example, including how the trailing stop works:

If the traded item is an ETF, which trades like a stock, there’s no direct way to short the item like there is in futures contracts, so we use leveraged (3X) bullish and bearish ETFs to allow for going long or short the item. For example, if you want to go long GDX, our nightly algo reports/signals show buying shares of NUGT. If you want to short GDX, our signals suggest buying shares of DUST. All back-testing results stats on ETF’s shown in the informational on-screen boxes are based on each trade being $10,000 worth of shares. Stops are also figured in dollar amounts, and are proportional to a $10K initial purchase.

Let’s say that a new buy signal has appeared in the nightly algo report on NUGT, the 3X bullish large cap Gold Miners ETF. When the buy signal candle appears, the algo is suggesting buying $10,000 worth of NUGT shares at the open of the next daily candle. Let’s say that the entry candle opens at $20 per share. You therefore buy 500 shares, or $10,000 worth @ $20 per share at the open. Based on 3-year back-testing and optimization, the algo suggests an initial fixed stop of $700. If the value of your 500 shares dropped by $700, your shares would then be worth $9300. $9300 divided by 500 shares equals $18.60 per share. Your initial fixed stop should therefore be set at $18.60. All stops on all Premium Plan and Crypto Plan covered items start with a fixed stop.

Most items that I cover back-test best when my AMA/Momentum Algo sticks with the initial fixed stop throughout the trade. A few items however back-test a little better if a trailing stop is also utilized. The trailing stop I use in Trade Navigator adjusts the level of the trailing stop at the open of each bar to be X number of dollars away from the price extreme so far in the trade. Using the NUGT algo again as the example, if an opposing small arrow appears during the trade, my AMA/Momentum Algo suggests changing the stop to a $1100 trailing stop.

Let’s say price has moved up from the initial buy entry point of $20, and peaks at $25 per share, but then pulls back to close at $23, and a small opposing arrow appears (down-pointing, in red). The algo is suggesting cancelling the initial fixed stop ($18.60), and initiating a new trailing stop $1100 below the high of the trade so far, which was $25. You still own 500 shares, which, at the high of $25 were worth $12,500. If the value of those shares dropped $1100 from that peak to $11,400, the share price would be $22.80. The new trailing stop should therefore be set to $22.80. When a trailing stop is in play, the stop should continue to be adjusted daily to $1100 below the “in trade high”, if a new “in trade high” has occurred.

Example of an ETF trade that utilizes a trailing stop:

As a reminder, our Premium Plan and Crypto Plan Nightly Screenshots will automatically show you the suggested level of the fixed and/or trailing stop all during the trade, after the trade has been underway for 24 hours. The initial stop, entered at the same time as the position entry, is the only time you will need to calculate the initial fixed stop level. It’s easy to do!

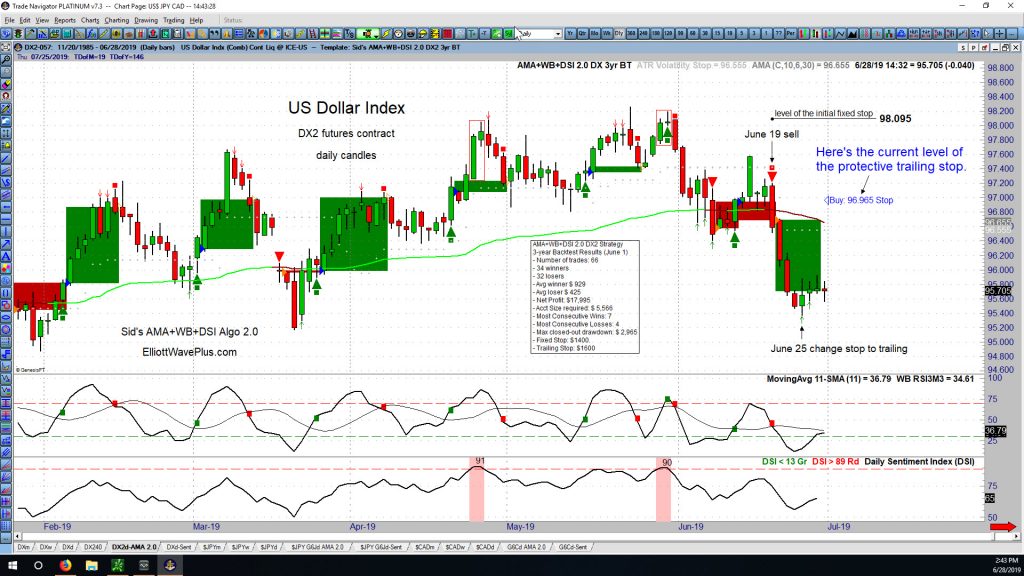

P.S. Both screenshots above show items that are not currently involved with a trade. The algo is “flat”. The screenshot of the US Dollar Index below shows what the nightly algo screenshots look like when an item is currently involved with a trade. Notice the automated algo notification of the current placement of the stop, which in this example, changed to trailing on June 25:

- Sid Norris – June 2019