Our Weekly “Counts” Webinar – April 19, 2025 – The entire recording

We usually hold a quarterly Premium Plan webinar a couple of weeks after the end of each calendar quarter, but this time, at this critical juncture in the markets, we are posting the recording of our most recent weekly “Counts” webinar as a free sample of our work.

Elliott Wave and Hurst Cycles Event Presentation

How Our Method of Combining Elliott Wave and Hurst Cycle Analysis is Far Superior to Elliott Wave Theory when used in isolation.

Synergy Traders Presentation – Elliott Wave Plus

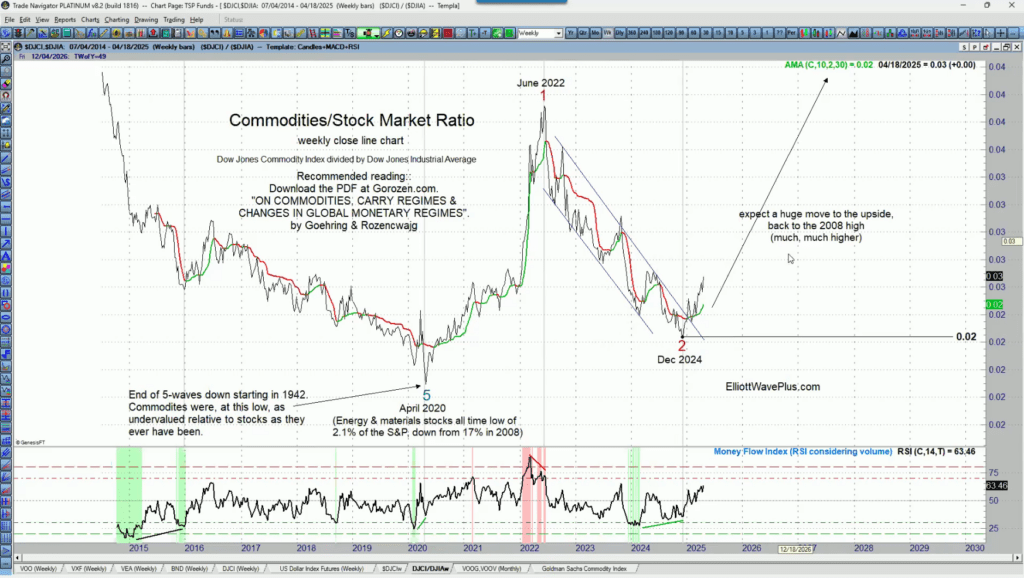

Who are the Commercials? What is their trading objective? Why Commercials positioning in Commodities are the most important Commercials to track. Check out Sid’s presentation here.

EWP Premium Plan Webinar Recording – January 16, 2025

We have included our re-optimized AMA Algo results as always! Please use the download link below so you can view/sort the results as you see fit. We have included a special offer to any new subscribers as well. If you’re interested in subscribing to Elliott Wave Plus, we have conveniently provided you a link to our pricing page. Thank you for supporting us!

EWP Premium Plan Webinar Recording – October 17, 2024

We have included our re-optimized AMA Algo results as always! Please use the download link below so you can view/sort the results as you see fit. We have included a special offer to any new subscribers as well. If you’re interested in subscribing to Elliott Wave Plus, we have conveniently provided you a link to our pricing page. Thank you for supporting us!

Elliott Wave Presentation for Synergy Traders

Our unique approach is well worth consideration, especially if you’ve never experienced wave labeling and associated Fibonacci price targets that are derived in harmony with independent Hurst cycle analysis. Here’s more info about subscribing.

Elliott Wave Hub Bi-Annual Event

We offer four subscription levels. The Premium Plan includes everything we do including daily momentum algo trade signals on over twenty items, as well as daily screenshots of our proprietary Sentiment Conditions template. The Pro and Premium plans include future roadmaps based on a combination of Elliott Wave and Hurst Cycles, as well as a “live” weekly Counts webinar. The Basic Plan includes the Elliott wave + Hurst cycles screenshots only (twice-per-week), but no weekly webinar. The entry level Trend Plan offers daily trend analysis (but no Elliott Wave or Hurst) on many popular items, plus momentum algo signals on Cryptos. It DOES include Elliott Wave daily and weekly counts on Bitcoin.

EWP Premium Plan Webinar

We have included our re-optimized AMA Algo results as always! Please use the download link below so you can view/sort the results as you see fit. We have included a special offer to any new subscribers as well. If you’re interested in subscribing to Elliott Wave Plus, we have conveniently provided you a link to our pricing page. Thank you for supporting us!

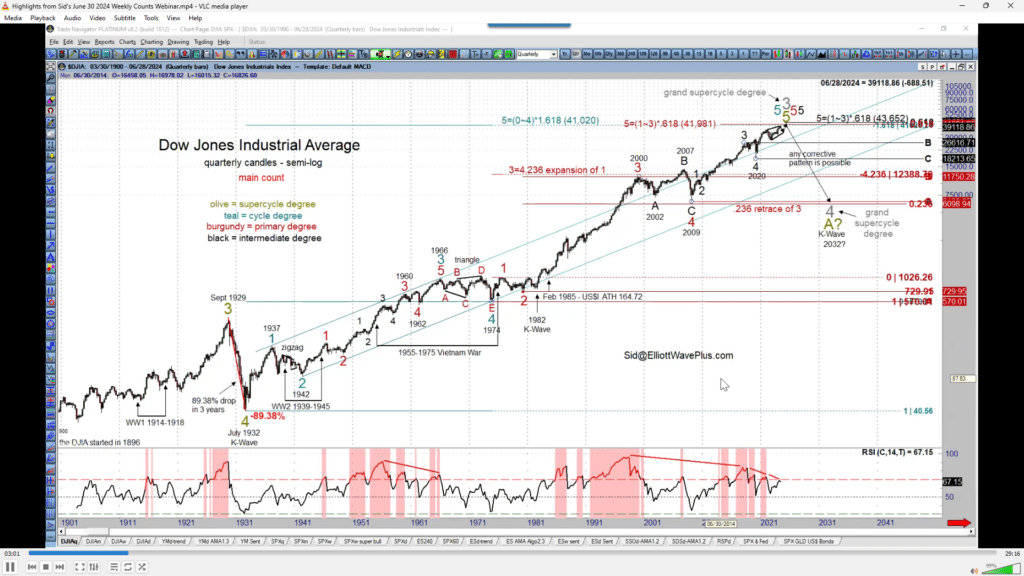

Highlights from Sid’s Weekly Counts Webinar

During Sid’s June 30, 2024 weekend webinar, Sid Norris of ElliottWavePlus.com showed what a bullish wave count would look like if the S&P-500 was in the process of carving out a 5-wave non-overlapping impulse starting from the March 2020 low. Spoiler Alert: The wave 3 up from that low has a wave target of 18,500 !!!

Elliott Wave Plus – Quarterly Premium Plan Webinar – April, 2024

The session gave very specific information about the design of our proprietary momentum algos, as well as our proprietary Sentiment Conditions screenshots. As always, several of our combined Elliott Wave / Hurst cycle analysis roadmaps on popular tradable instruments was revealed. Be sure to view and/or download the spreadsheet that shows the most recent backtest results on our optimized algo trading signals below.