There’s an FOMC meeting and announcement next week. What’s the likely market reaction in silver?

My work as a market technician is generally based on the premise that markets move due to technical aspects derived from prior price action. However, very large players with an agenda (ie: central banks around the globe) are actively involved in the markets. Can looking at both the technicals and the influence of the FED provide greater insight into market forecasts? Let’s take a look.

A longtime subscriber (Thanks C.M.!) recently researched the last ten “reactions” in silver prices to FOMC announcements. Here’s what he found:

FOMC meeting dates & the corresponding silver price action

- Dec. 15-16, 2015 – major low on Dec. 14, 2015

- Mar. 15-16, 2016 – swing low on Mar. 15, 2016

- Jun. 14-15, 2016 – swing high on Jun. 16, 2016

- Sept. 20-21, 2016 – major high on Sept. 22, 2016

- Dec. 13-14, 2016 – retest swing high on Dec. 14, 2016

- Mar. 14-15, 2017 – major low on Mar 15, 2017

- June 13-14, 2017 – swing high on Jun 14, 2017

- Sept 19-20, 2017 – continued down trend; no swing highs or lows

- Dec. 12-13, 2017 – major low on Dec. 12, 2017

- Mar. 20-21, 2018 – major low on Mar. 20, 2018

As you can see, nine of the last ten FOMC meetings have coincided with significant turns in silver.

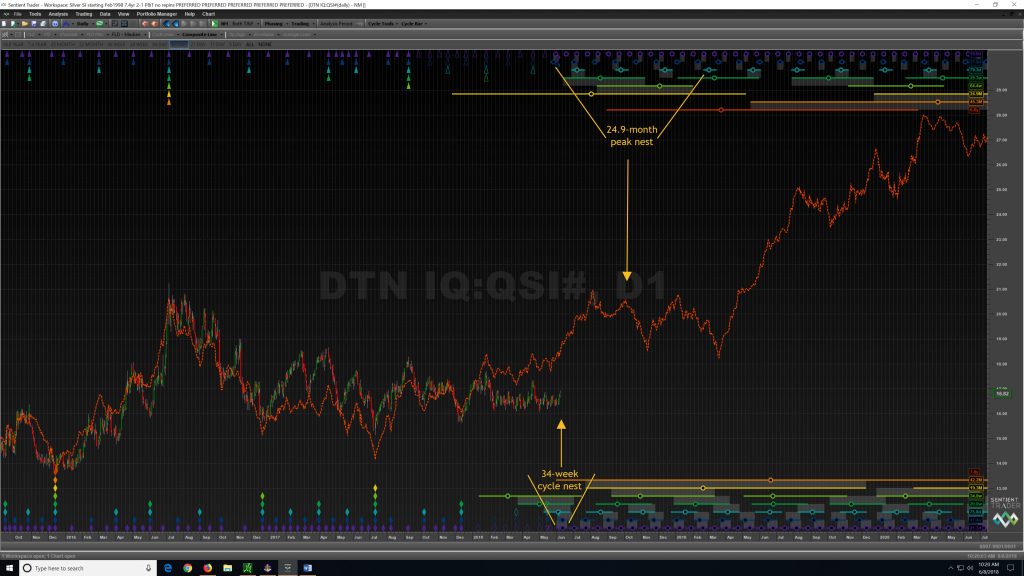

But is the FOMC announcement the catalyst, or something else? In recent years, I’ve been utilizing a custom 7.4-year Hurst cycle model on silver, programmed into Sentient Trader software. Starting with a 7.4-yr cycle, each lower cycle in the model is expected to be approximately half the duration of the larger cycle. The model considers both peaks and troughs independently. That model has been able to project fairly tight date ranges for near-term swing highs and lows over the past 2 years in precious metals quite well, in my opinion. Currently, the model is projecting that a large (34-week) cycle trough is due right about now, and may have already occurred in Silver, Gold, Platinum, and the precious metals miners.

Here’s a screenshot of the current Silver analysis utilizing my “7.4-year 2:1 ratio” custom model. Future nests of cycle troughs and peaks are shown, as well as the orange “composite line” with takes all cyclic information into consideration as it projects future price direction. Click on the chart to enlarge.

The bottom line:

A proper cyclic model appears to project future swings in price action in advance, but market participants tend to wait for the nearest FOMC announcement before committing strongly to the silver trade.

Sid Norris – ElliottWavePlus.com