The Fed, The US Dollar, or Bonds?

by Sid Norris of Elliott Wave Plus

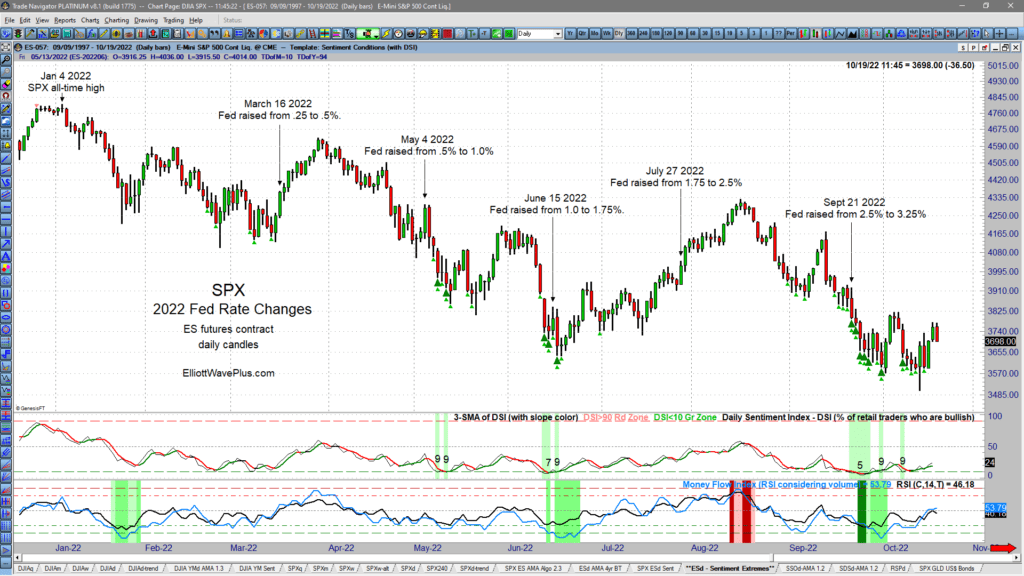

What’s been driving the markets this year? If your market research consists primarily of watching financial television channels, you’d swear that the Fed must be controlling all market movements like it was a puppet master! The vast majority of TV pundits will answer questions about where the market is going next with at least some mention of the Fed. Let’s look at all the Fed’s rate changes so far this year to see if they are producing consistent buy or sell signals for investors and traders:

(click on images to enlarge)

As you can clearly see, the market has been responding to Fed rate-change days in random fashion. Sometimes the market reacts to the upside, sometimes to the downside, and sometimes there appears to be no reaction at all.

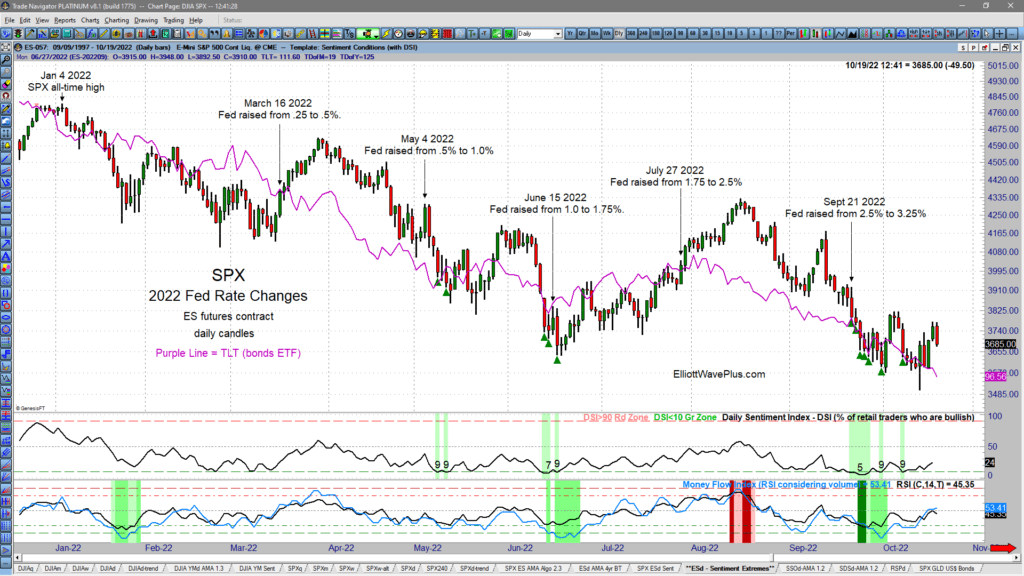

What about Bonds, then?

So, if the Fed rate changes are not a consistent driver of the stock market what is? Let’s look now to see if Bonds and the stock market have been more closely correlated this year:

Obviously, the Bond market and the stock market have been highly correlated this year. It appears that if the stock market is going to reverse course to the upside, bonds will need to stop going down. Also notice that bonds and the stock market were well underway to the downside when the Fed started raising rates on March 16, 2022, for the first time since they moved to a zero-rate policy on March 19, 2020. In fact, bonds topped way back in early March 2020. This proves that the Fed was not the “cause” of the downward movement in the stock market starting from the Jan 4, 2022, all-time high. The Fed has simply been adjusting its rates to chase the trend of the bond market as they always do, in lagging fashion.

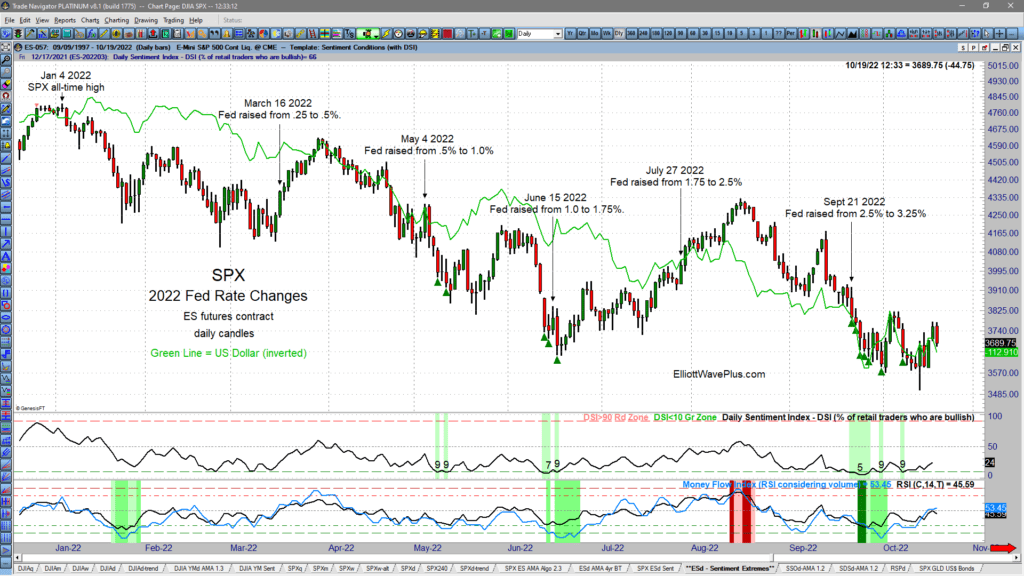

How about the US Dollar? Has it been driving the markets?

As you can see, as the US Dollar (shown inverted on the chart) has moved up this year, the stock market has gone down, and in a highly correlated fashion, especially in recent days. Notice that over the last five days or so, the stock market has shown a bit of a bounce, and so has the US Dollar. Bonds on the other hand have continued a bit lower over the last few days.

Summary

What’s driving the markets this year? It is first and foremost the US Dollar, followed closely by Bonds. The stock market clearly needs the Dollar to top, and bonds to bottom if it’s going to put together a sustained rally here. Also, it appears that the stock market, at least over the last few days, is more closely tied to the inverted US Dollar than it is to bonds. In other words, if the stock market is going to continue the upside bounce that started Oct 13, it mostly needs the dollar, which peaked back on Sept 28 to break lower.

Our System

Over the years, we’ve found several methods of technical analysis to be worthy of constant consideration when trading. This combination of robust forms of technical analysis creates an integrated approach to trading that is more powerful than Elliott Wave theory analysis alone. Our analysis combines:

- ELLIOTT WAVE (W/ FIBONACCI PRICE TARGETS)

- HURST CYCLE ANALYSIS

- EXTREME SENTIMENT POSITIONING

- INTER-MARKET CORRELATIONS

- MULTI-TIMEFRAME DIVERGENCES

- SEASONALITY

- ALGORITHMIC TRADE SIGNALS

Our Subscription Services

Elliott Wave Plus subscription choices include nightly or twice-per-week screenshots, weekly webinars, automated trade signals, and sentiment conditions updates.

Subscriptions

We offer four subscription levels. The Premium Plan includes everything we do including daily momentum algo trade signals on over twenty items, as well as daily screenshots of our proprietary Sentiment Conditions template. The Pro and Premium plans include future roadmaps based on a combination of Elliott Wave and Hurst Cycles, as well as a “live” weekly Counts webinar. The Basic Plan includes the Elliott wave + Hurst cycles screenshots only (twice-per-week), but no weekly webinar. The entry level Trend Plan offers daily trend analysis (but no Elliott Wave or Hurst) on many popular items, plus momentum algo signals on Cryptos.

Sid’s unique approach is well worth consideration, especially if you’ve never experienced wave labeling and associated Fibonacci price targets that are derived in harmony with independent Hurst cycle analysis. Here’s more info about subscribing.

An overview of our pricing can be found here.

Be sure to subscribe at our YouTube channel.

Follow us on Twitter

Follow us on Facebook

(There is risk of loss in all trading. See the full disclaimer at our site.)

Testimonials

“Hi Sid…I’ve been looking for an excuse for a while to pay you a well-deserved compliment. I find your insight on the markets to be SPOT ON and continue to make good money following your expert guidance. Just recently retiring myself, I feel confident that my nest egg is safe and in position to grow (exponentially) with your guidance. I’ve tried a lot of trading services in the past and find you to be an exception to ALL of them in quality of material, integrity and transparency, and feel no reason to ever look elsewhere.” – K.B.

“One of the traders in my group told me she attended and loved your webinar! She has been spending time reviewing my notes and saved screen shots from previous EWP webinars and comparing them to my past trades made during the week following online seminar. Her comment to me today: EWP at first glance, appears to be too good to be true. But after reviewing the successful trades you made based on EWP, it becomes even more unbelievable!” – W.H.

Click here for way more testimonials spanning the last ten plus years.