Free In-Depth Look At Our Nightly Algo Report

Recent market action has piqued a lot of people’s interest in our work here at ElliottWavePlus.com. We’ve received many inquiries about our levels of service, including our automated algorithmic trading signals. In case you are unfamiliar, we provide nightly algo trade signals (M-F) to our Premium-Plan subscribers. You can read more about that service here. Our carefully constructed algorithms are based on a number of technical factors like momentum, sentiment, trend-following, etc. We’d like to share with you some examples of our work for subscribers, along with a few screenshots.

First off, we periodically send out our algo’s historical trade specs on dozens of tradeable items in the form of a sort-able excel spreadsheet. You may have downloaded one from our previous blog posts. This sheet shows how profitable our automated algorithmic trade signals have been over the past three years, and provides a number of sort-able statistics about the trading results. You can check out our most recent spreadsheet here. But that doesn’t tell the entire story.

We’d like to give you a more in depth look at an AMA momentum algo chart that our Premium Plan subscribers received last night, as well as the associated sentiment conditions screenshot and PDF “quick check” summary. All of those items are provided to Premium Plan subscribers nighty (M-F).

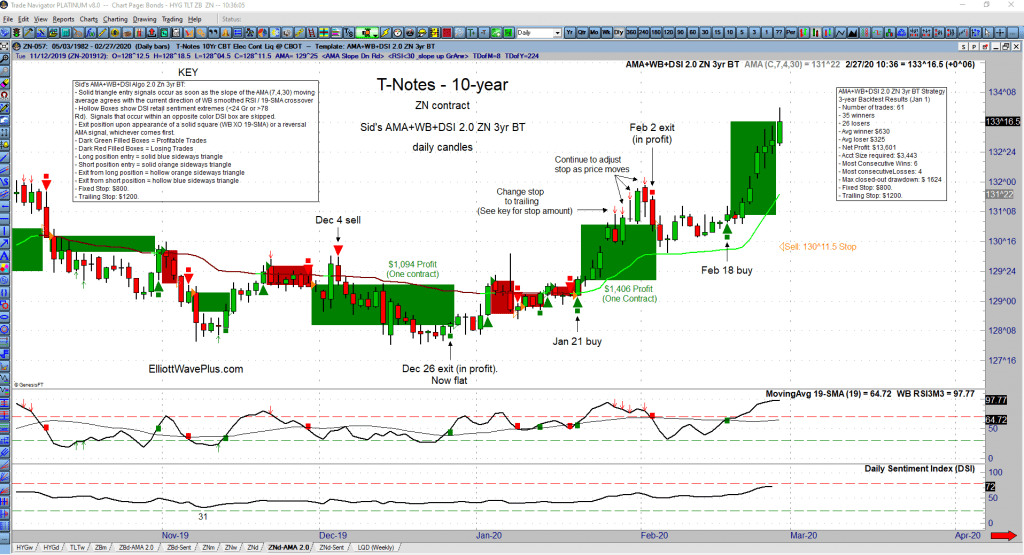

Our Proprietary Momentum Algo – ZN Bonds Contract – Current Screenshot:

Here’s one of the tradeable items we cover on our Nightly Report, the ZN contract (10-year T-Notes). This is a very high-volume contract, so great fills on orders can be expected, with very small bid-ask spreads pretty much all the time.

Subscribers quickly become acclimated to our easy-to-see indicators on these charts. For example, notice the “Walter Bressert” RSI3M3 indicator (along the bottom of the chart, just above the Daily Sentiment Index indicator. It is currently still moving up (barely), and is well above it’s moving average. This most recent up-move has been been very strong, and the algo has stuck with the trade, and will continue to do so until a measurable loss of momentum occurs. Our algo’s ability to capture a large percentage of these occasional big, aggressive moves is a key factor to the excellent profitability history of our system.

Based on a 3-year backtest and optimization, here are a few key highlights on how well our system has traded this item. All historical trade results are shown on the chart. The green boxes were profitable trades. The red boxes were losing trades.

Trading One Contract – 3-Year Results

Required starting account size: $3443

Number of Trades: 61

Winning Percentage: 56.2%

Average Winner: $630

Average Loser: $325

Net Profit: $13,601

As you can see, the winning trades, visually represented by the green boxes are much larger (on average) than the much smaller losing trades, visually represented by red boxes. As of this writing, we are still on a buy signal from Feb 18, and that trade is well into profit. This chart is updated and sent out every evening. Action items (the trade entry signal, initial fixed stop size, trade maintenance (when and if to change to a trailing stop, and how big that stop should be), and the trade exit signal can all be seen on the charts, as well as in our nightly summary PDF report.

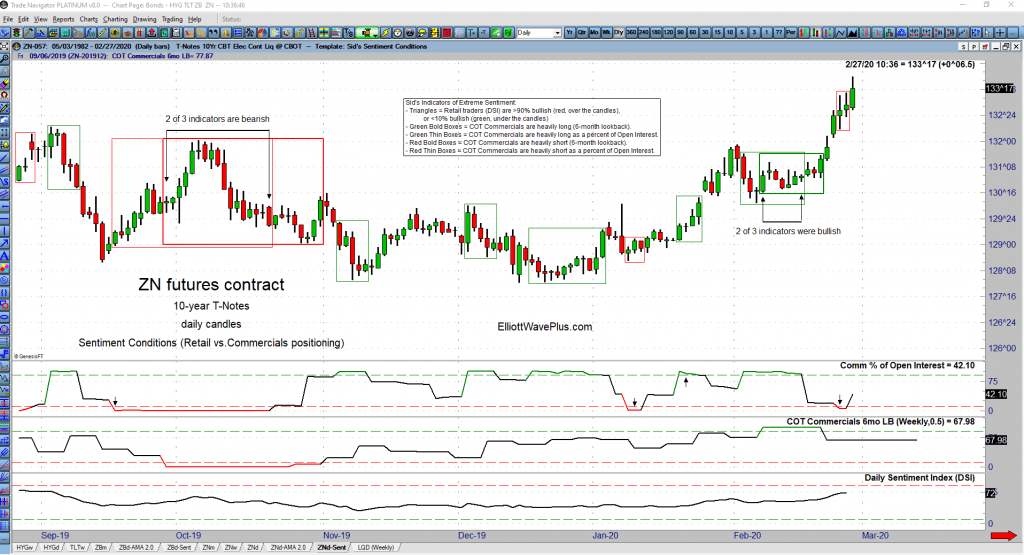

Also Included Every Night for Subscribers: Our Sentiment Conditions Chart:

The Sentiment Conditions screenshot shows Retail vs Commercials positioning. Occasionally, our algo will suggest ignoring a momentum trade signal if the sentiment conditions are unlikely to provide additional profitably. The algo’s ability to ignore a momentum trade signal is based on back-tested and optimized extreme sentiment thresholds. Details are displayed on the chart. Once again, this chart is updated and sent out to Premium Plan subscribers every evening.

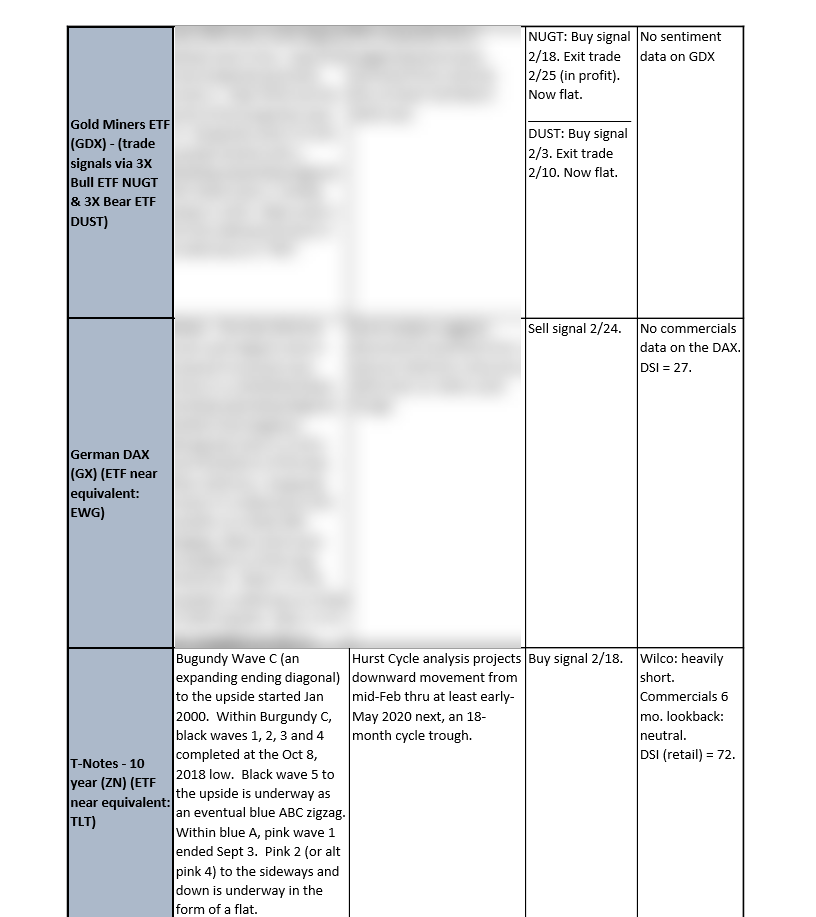

A portion of a recent Nightly PDF Report:

The above is a portion of our nightly PDF “quick check” report. It shows Sid’s current Elliott Wave count, Hurst Cycle analysis, AMA (momentum) Algo trade status, and Sentiment Positioning on over 20 popularly traded items. See the full list here. This is updated and sent out to Premium Plan subscribers every evening.

Conclusion:

Trading doesn’t have to be time consuming. We generate this in-depth report five days a week so subscribers can take just 10 minutes out each early evening to see what trading opportunities are presenting themselves. Being versatile and knowledgeable about different tradeable contracts and ETF’s in different sectors, commodities and currencies benefits traders greatly, especially in times like these, where passive stock-market indexers have been getting scorched. Yes, there are more things you could be trading other than the S&P! End the tunnel vision, and expand your possibilities! Be on the lookout for more in-depth blogs, and please check out our free “Resources” tab at the site.

Subscriptions:

We offer a number of subscription levels. Some are mostly about Elliott Wave and Hurst Cycles, and others are based on automated algorithmic trade signals. Sid presents his Elliott wave counts, which include integrated Hurst cycle analysis on over one hundred trade-able items for subscribers (Basic Plan & up) every weekend. He sends out updates on about half of those items every Wednesday. Crypto and Premium Plan subscribers receive automated trade signals, as described in this blog post. Sid’s unique approach is well worth considering, especially if you’ve never experienced wave labeling and associated Fibonacci price targets that are derived in harmony with independent Hurst cycle analysis. Here’s more info about subscribing.

Be sure to subscribe at our YouTube channel.

Follow us on Twitter

Thanks for reading.

(There’s risk of loss in all trading. See the full disclaimer at our site.)

Testimonials:

“Sid, you continue to yield remarkable results – your silver analysis has been nothing short of spectacular this year and I have made enormous profits this year thanks to it. Booked another huge silver profit (this time short) based on your perfect analysis. God has blessed you my friend with great wisdom- thanks for sharing it with others!” – J.F

“I’ve been trading these markets (and subscribing to professional services) for more than forty years and find your work and resulting forecasts, targets, objectives, etc. to be free of personal bias, and remarkably accurate. That is why I continue to subscribe. Well done.” – W.M

Click here for many more testimonials spanning the last ten plus years.