Hurst Cycle Analysis

How Hurst Cycle Analysis Improves Our Elliott Wave Counts:

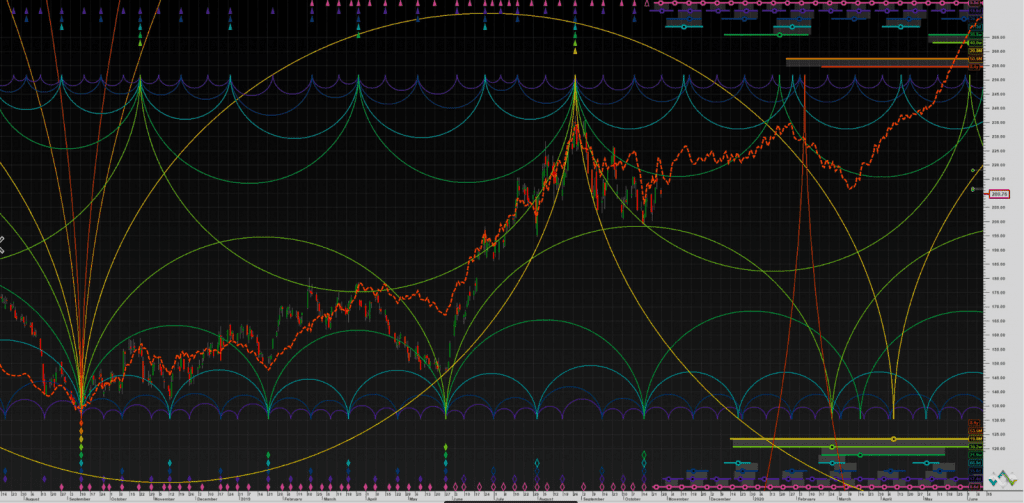

Hurst cycle analysis provides a road-map of cyclical (recurring) trend changes at all time frames within financial markets. At any given time, there are many cycles acting on the market. Our method of utilizing Hurst cycle analysis unveils eleven cycles operating simultaneously in the markets. These cycles vary in length from 18-years to 5 days.

As you can see, the many cycles overlap each other. Generally, if the majority of cycles are moving to the upside currently, price tends to go up. Conversely, If the majority are leaning to the downside, price tends to go down. The higher the percentage of the eleven cycles that are currently in agreement, the stronger (faster) the price movement.

As Hurst cycle clusters (nests of multiple cycles) are arrived at chronologically, a price top or bottom occurs, resulting in a trend change. We refer to these moments in time as nested cycle “peaks” or “troughs”. These areas are ideal buying or selling opportunities and add a critical timing element to our Elliott wave counts.

We apply the current Hurst cycle analysis to all our charts, as seen in our webinars and screenshots. We then project Elliott Wave counts and associated Fibonacci price targets in harmony with the Hurst future roadmap. The combination of these two robust, independent methods provides a great “check and balance” system that we believe is more accurately predictive that either method, when used in isolation.

No system is perfect, but since adding Hurst cycle analysis to our Elliott Wave counts several years ago, we simply don’t have to revise our wave counts nearly as often as we used to. That’s why we can cover so many items. We’re not constantly bouncing from one wave count to another, relabeling the same chart over and over.

The Bottom Line:

By combining robust methods of technical analysis (Hurst cycle analysis, Elliott wave theory and its associated Fibonacci price targets, extreme sentiment positioning, algorithmic trade signals based on momentum, indicator divergences, etc.), our problem-solving power is increased, providing higher confidence trading opportunities.

Education:

Every week, Sid hosts a weekly “Counts” webinar for Pro and Premium Plan subscribers. During the webinar, he teaches Hurst Cycle Analysis and how it fits into his Elliott Wave counts.

Here’s an example video of how Hurst analysis offers critical information to wave counters: https://www.youtube.com/watch?v=9nf-PCahEis&t=127s

Testimonials:

“Just want to thank you creating a service that is exceptional. I trade for a living , and you are indispensable. Thanks in part to you, I had a remarkable summer of trading , booking more than $220,000 in profits since May. Keep up the great work and know that you are making a huge difference in people’s lives!” – J.F. August 2019

“Sid, You have done an amazing job with your calls the past few months. Your ability to read the Hurst tea leaves is incredible. Really well done.” – P.T. May 2019

Click here for more testimonials.

How to Subscribe

Please consider a subscription! Just head over to Elliott Wave Plus and be sure to check out the free resources. If you have questions regarding subscription, please email me at [email protected]. Thanks for reading.

Sid Norris – https://elliottwaveplus.com/