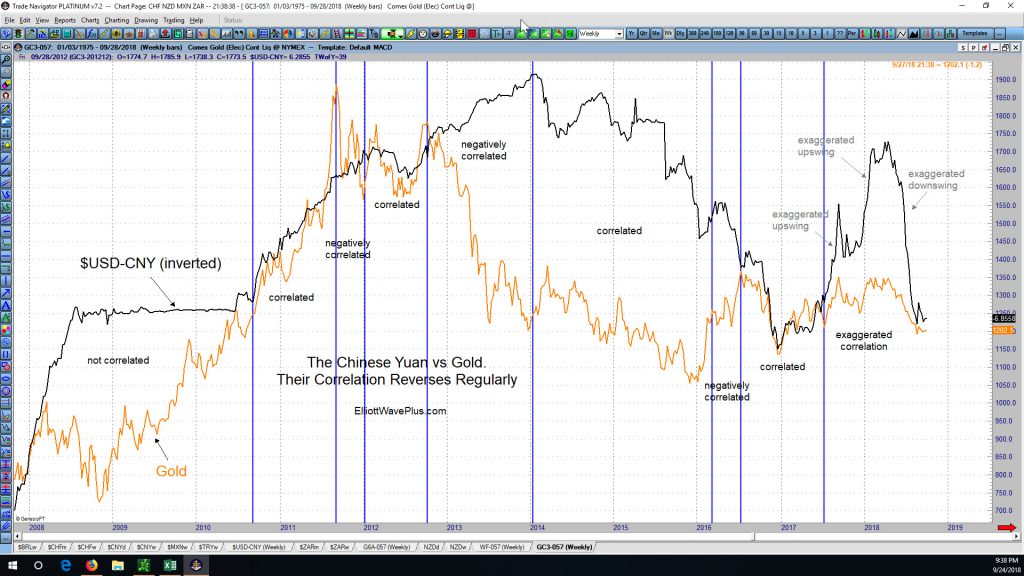

The Chinese Yuan vs Gold. How Correlated Are They?

I’ve seen a number of articles lately from various sources stating that the Chinese government is essentially now in full control of the price of Gold. Admittedly, from mid-June through mid-August of this year, the price of gold moved to the downside during the exact same period that the Chinese Central Bank was resetting the Yuan against the US Dollar to offset the effects of the Trump trade war tariffs. But is this recent correlation between the Chinese Yuan and Gold a certainty moving forward? The answer is NO. While there is, from time to time, a high correlation between the two, it never holds, and the correlation actually reverses to a fully negative correlation regularly.

For example, from October 2012 through January 2014, the two were negatively correlated. And that’s not the only period of negative correlation in recent years. Here’s a chart to prove the point: (click to enlarge)

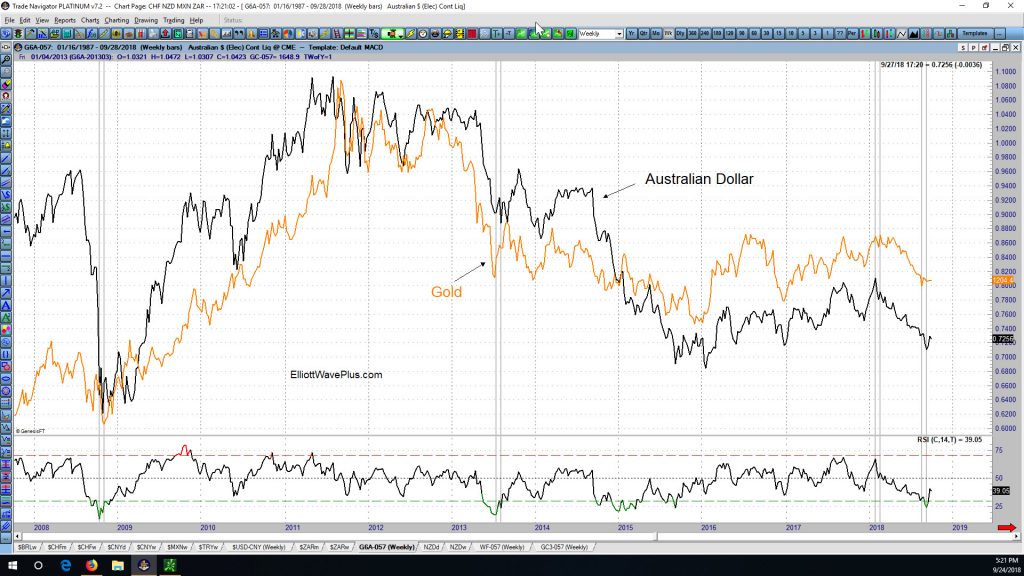

So the supposed Yuan/Gold correlation is unreliable. Is there a currency whose correlation with Gold is more consistent? The answer is a resounding YES. As I pointed out in my last blog post, price movements in Gold are very reliably correlated historically with the Australian Dollar. Here’s that chart again:

Why are price movements in Gold and the Australian Dollar so tightly correlated? There reason is not technical. It is fundamental. Mining is a very large and important sector within the Australian economy. The Australians are very good at digging stuff up and selling it!

Conclusion:

The correlation between the Chinese Yuan and Gold rotates regularly from positive to negative, and is therefore unreliable. However, the correlation between Gold and the Australian Dollar is historically much more consistent. This is very important because the Elliott Wave count, associated Fibonacci price targets, and Hurst cycle analysis in one can strongly suggest what is likely to happen next in the other.

Invitation:

Please join me for my next weekly “Counts” Webinar, where I go over my Elliott Wave counts and associated Fibonacci price targets for many of the world’s major stock markets, commodities, currencies and bonds. Hurst cycle analysis as well as a number of other forms of technical analysis will also be considered on virtually all items. Don’t have time for a webinar? There are three tiers of paid subscriptions to choose from. A growing number of traders worldwide trust and prefer the information we provide. Thank you for your consideration.

Sid Norris – ElliottWavePlus.com