U.S Dollar Index – Algo Trade Signals and Sentiment Positioning 2020

It’s been another profitable month for our Nightly Algo Report for Premium Plan subscribers here at ElliottWavePlus.com. In this post. we’ll provide an in-depth look at the U.S Dollar Index, and the trade signals that our proprietary momentum algorithm has been producing. Remember, this is just one of twenty popularly traded items covered for our Premium Plan subscribers, who receive screenshots every evening (M-F), along with a summary “check list” PDF. Click here for a complete list of items covered.

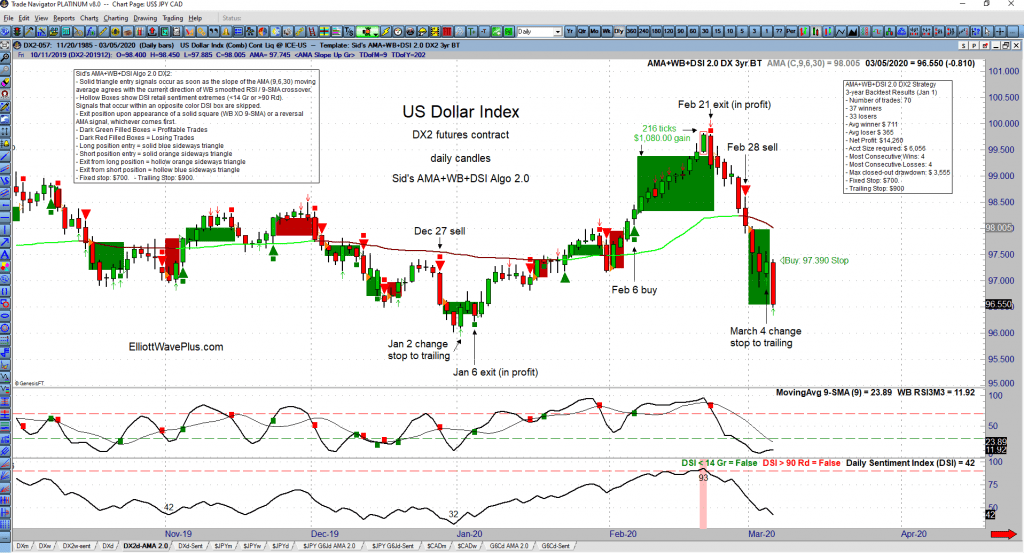

US Dollar (DX) – Nightly Algo Report AMA Screenshot:

Since the beginning of the year, the U.S Dollar Index has been locking in some large profitable trades, while keeping losses to a minimum. The biggest move caught by the Algo was from Feb 6 – Feb 21. This move locked in just over $1,000 in profit, if trading one contract. As of this writing, there is an existing short position that took was triggered on Feb 28, and a trailing stop has been implemented. Winning trades, visually represented by the green boxes are much larger (on average) than the much smaller and less frequent losing trades, which are visually represented by red boxes. Action items (the trade entry signal, initial fixed stop size, trade maintenance (when and if to change to a trailing stop, and how big that stop should be), and the trade exit signal can all be seen on the charts, as well as in our nightly summary PDF report.

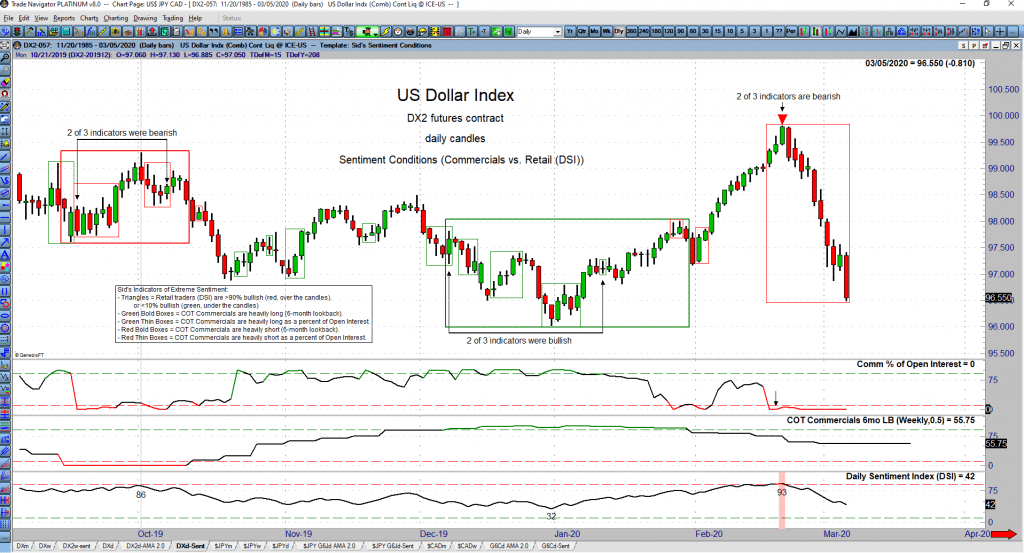

US dollar (DX) Nightly Algo Report Sentiment Conditions Screenshot:

Sentiment positioning can also be visualized every night by Premium Plan subscribers. Our Sentiment Conditions template includes Commercials as a percent of open interest, Commercials 6-month lookback (how Commercials are currently positioned in relation to their most bullish and bearish positioning within the last 6 months), and the current percentage of Retail traders that are currently bullish (DSI). Our momentum algo automatically ignores momentum trade signals if current sentiment levels are are beyond backtested and optimized extreme sentiment threshold levels. In this example, if over 90% of retail traders are currently bullish, the algo will refuse to take a new momentum buy signal. The threshold level is determined by backtesting on each contract. Details are displayed on the chart.

Conclusion:

Timing is everything! No system is perfect, but considering Sid’s Elliott Wave & Hurst Cycle analysis in conjunction with these algorithmic momentum trade signals can help traders decide when to get in and get out. Recent volatility in the market is leaving many people wondering what’s next. Future Elliot Wave road maps and momentum-based trade signals can aid in navigating these rough waters. As always, please check out our free resources at the site.

Subscriptions:

We offer a number of subscription levels. Some are mostly about Elliott Wave and Hurst Cycles, and others are based on automated algorithmic trade signals. Sid presents his Elliott wave counts, which include integrated Hurst cycle analysis on over one hundred trade-able items for subscribers (Basic Plan & up) every weekend. He sends out updates on about half of those items every Wednesday. Crypto and Premium Plan subscribers receive automated trade signals nightly, as described in this blog post. Sid’s unique approach is well worth considering, especially if you’ve never experienced wave labeling and associated Fibonacci price targets that are derived in harmony with independent Hurst cycle analysis. Here’s more info about subscribing.

Be sure to subscribe at our YouTube channel.

Follow us on Twitter

Thanks for reading.

(There’s risk of loss in all trading. See the full disclaimer at our site.)

Testimonials:

“Just a note to let you know how much I enjoyed the webinar tonight. I learned so much. I think every trader needs to be introduced to the Elliott Wave Theory and will be recommending that my trading friends sit in on one of your sessions soon. Your presentation cleared up many questions for me and challenged me to dig deeper into Elliott Wave. Best wishes to your continued success. Keep up the good work with the weekly videos too. I have sent your link to many of my friends” – D.L

“Your webinar this past Sunday was the single BEST product on this subject that I’ve ever purchased. I look forward to being a consumer of your work in the future.” – S.J

Click here for many more testimonials spanning the last ten plus years.