How To Spot Fake Financial News

Wouldn’t it be nice to see a financial news report that simply reported the facts? For instance, the following would be an example of accurate reporting: “The stock market was down X percent today.” But the following is how financial media always reports the news: “The stock market was down X points today on {insert a rationale here}.” Stating ANY REASON for movements in the stock market is more than suspect. It is the perfect example of fake news.

Carnage in the Currency Markets – Is It Over Yet?

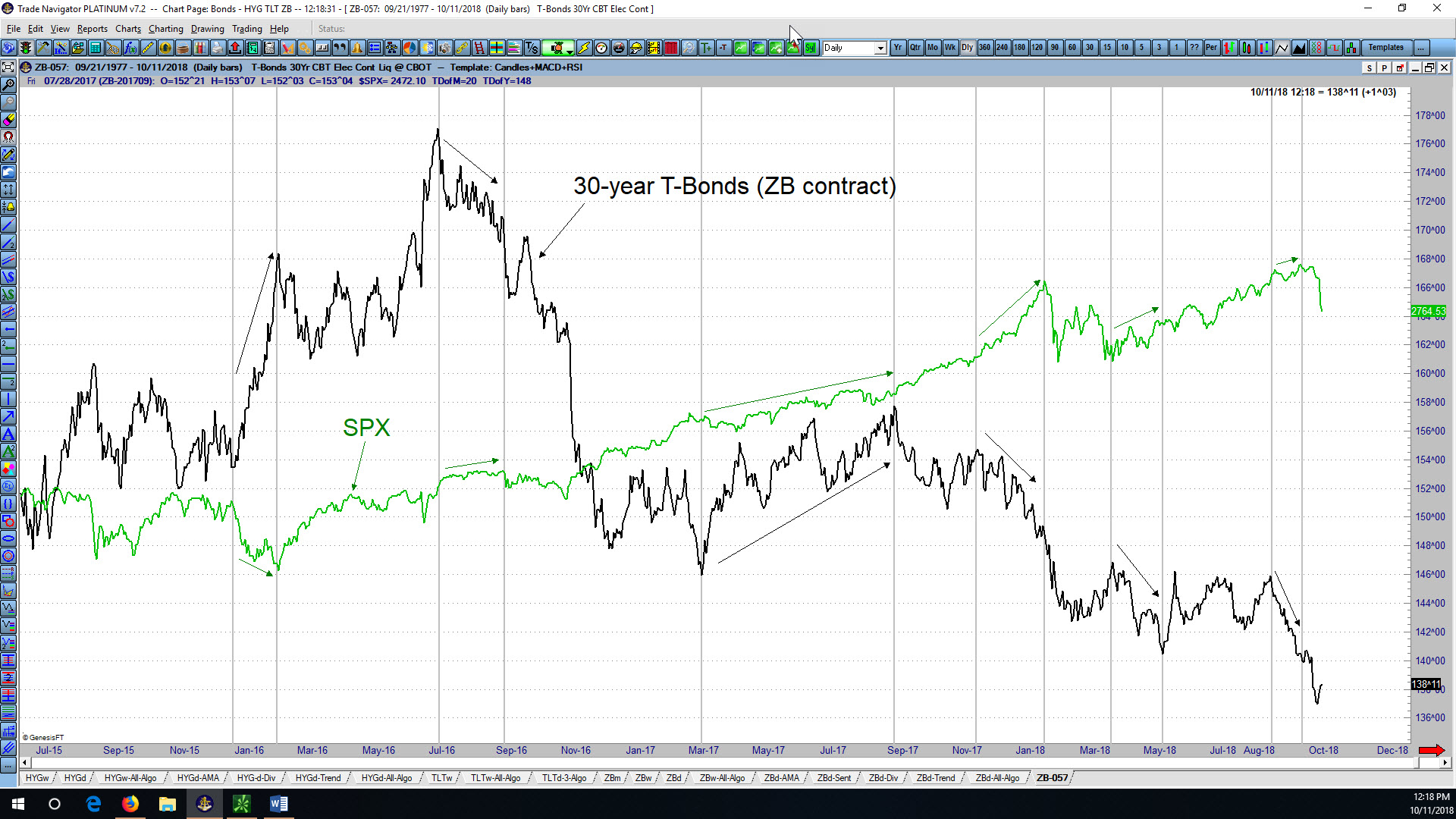

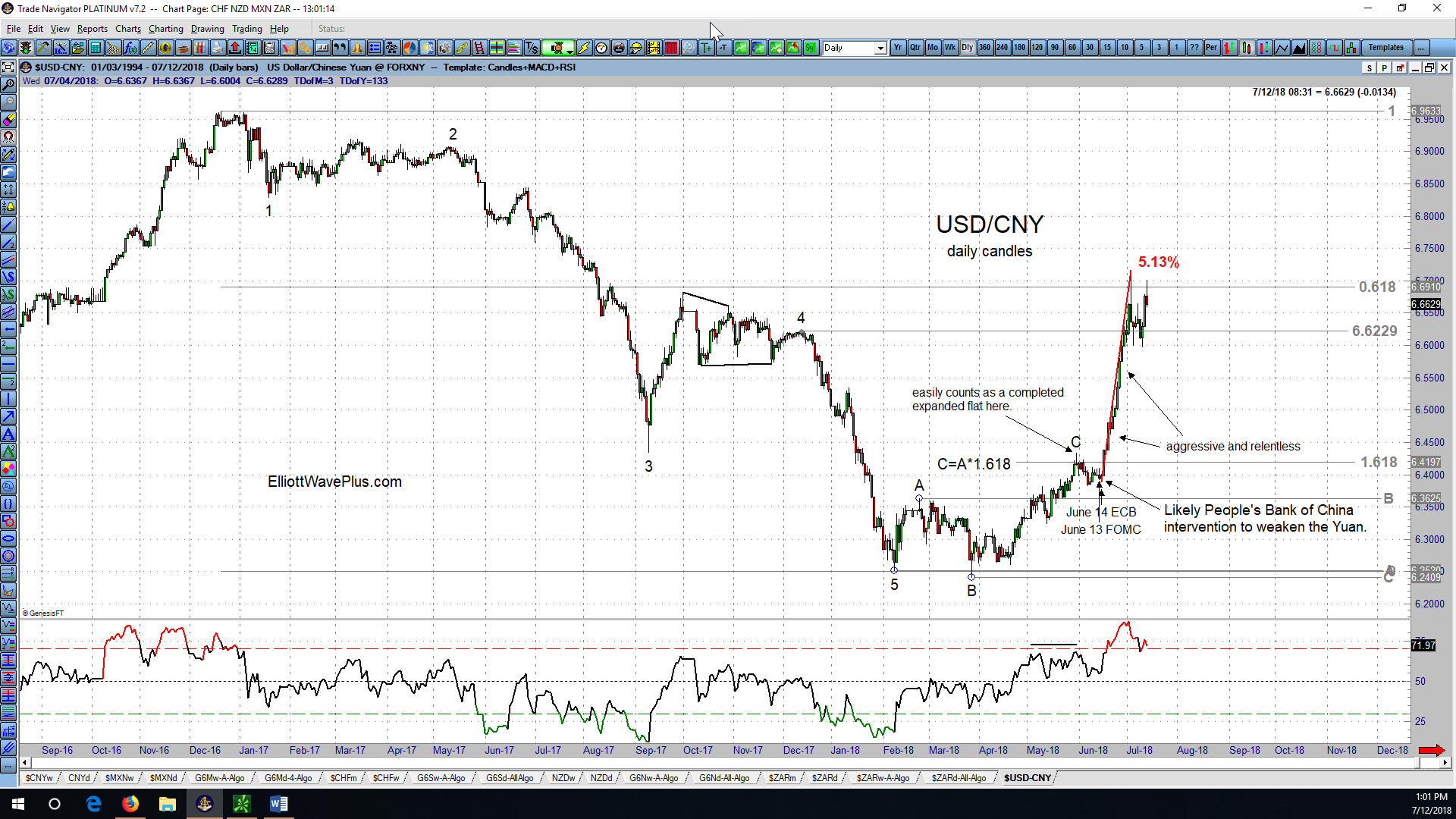

The recent “trade war” continues to show itself in numerous unusually aggressive price movements in the currency markets. Huge, fast movements in currencies profoundly affects all markets, but most of all commodities. Trader sentiment hits rare extremes, and quite simply, there is blood in the streets. Lets take a peak at just a few currencies to see if there are any technical reasons that suggest an end to the recent carnage.

Charting the Effects of the Trade War

The recent “trade war” appears to have triggered several aggressive price movements in the financial markets. The most obvious reactions are in tariffed commodities like soybeans and lean hogs. But, there are other recent price movements, specifically in the currency market that appear most likely to have been caused by direct government and/or central bank intervention. These currency interventions have affected, at least in the short term, the pricing in numerous commodities, some more than others.