Carnage in the Currency Markets – Is It Over Yet?

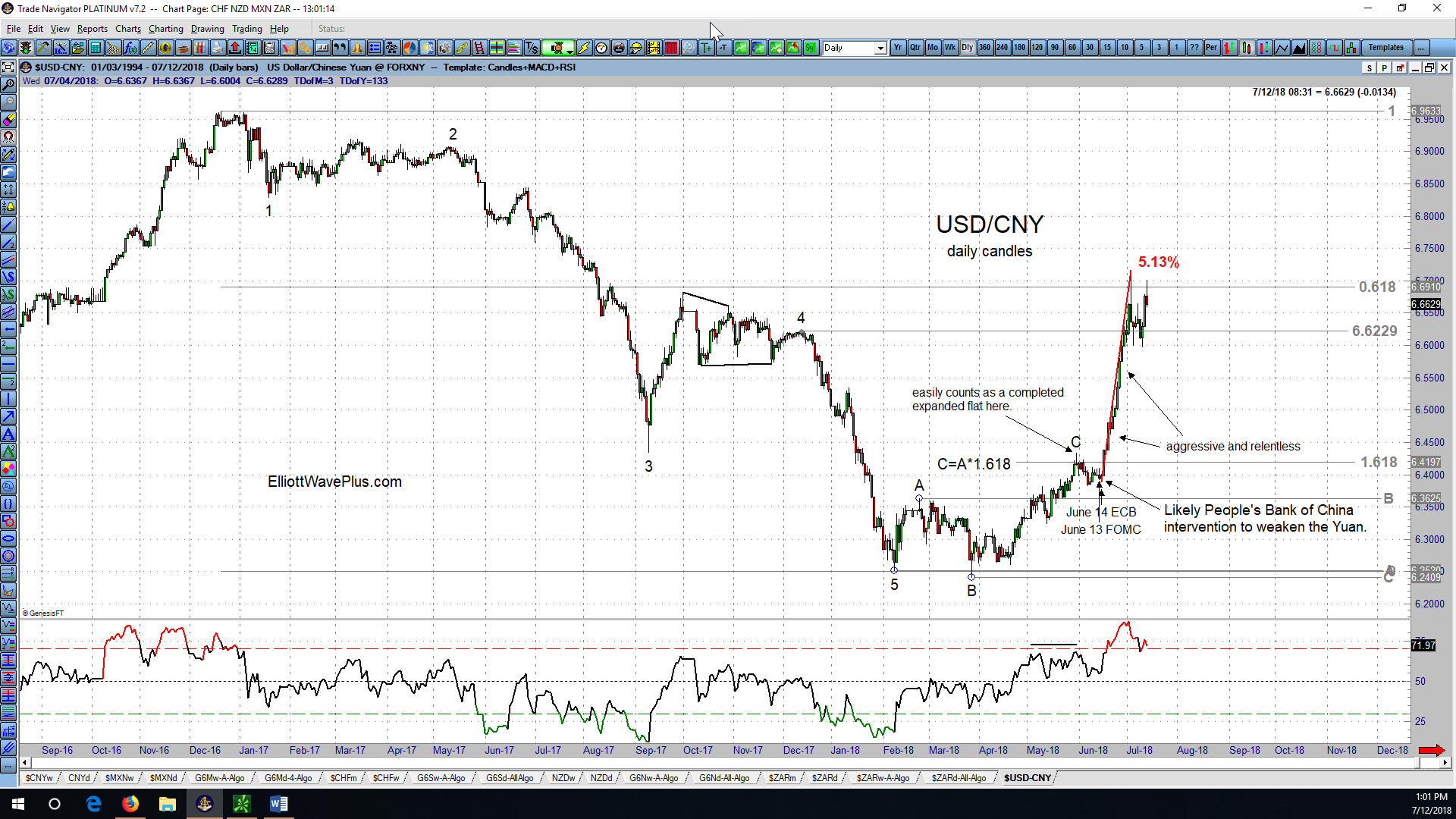

The recent “trade war” continues to show itself in numerous unusually aggressive price movements in the currency markets. Huge, fast movements in currencies profoundly affects all markets, but most of all commodities. Trader sentiment hits rare extremes, and quite simply, there is blood in the streets. Lets take a peak at just a few currencies to see if there are any technical reasons that suggest an end to the recent carnage.

Charting the Effects of the Trade War

The recent “trade war” appears to have triggered several aggressive price movements in the financial markets. The most obvious reactions are in tariffed commodities like soybeans and lean hogs. But, there are other recent price movements, specifically in the currency market that appear most likely to have been caused by direct government and/or central bank intervention. These currency interventions have affected, at least in the short term, the pricing in numerous commodities, some more than others.

What’s Next for the US Dollar? (by Sid Norris of ElliottWavePlus.com)

The US Dollar has been quite weak since the beginning of last year. Will it continue to weaken? The monthly chart below shows my long-time main Elliott Wave count for the US Index, an unfinished ending contracting diagonal starting at the 1985 high. This wave count correctly expected the US Dollar to top near a .618 retacement of the downward wave from July 2001 through March 2008. That top came in early January 2017, and the Dollar has surprised many by moving strongly lower ever since. Hurst cycle analysis also correctly projected that top, and from a long-term perspective is quite bearish the Dollar moving forward, potentially all the way to the year 2027.

Elliott Wave Analysis of the EUR/USD Currency Pair by Sid from ElliottWavePredictions.com

Elliott Wave Analysis of the EUR/USD Currency Pair by Sid from ElliottWavePredictions.com. Click on the chart twice to enlarge. The “Teflon Euro” has stayed amazingly resilient for a full year now after the initial calls for the end of a multi-year triangle emerged in February 2013. The above wave count shows that the Euro may have one more trick […]

Elliott Wave Update on the USD/CHF Currency Pair by Sid from ElliottWavePredictions.com

Elliott Wave Update on the USD/CHF Currency Pair by Sid from ElliottWavePredictions.com. Click on the charts twice to enlarge. Necessity is the mother of invention, and after the invalidation of count on the USDCHF pair (shown in the previous free post), here is the slightly revised wave count. The bottom line: It appears that the […]

Elliott Wave Analysis of the USD/CHF Currency Pair by Sid from ElliottWavePredictions.com

Elliott Wave Analysis of the USD/CHF Currency Pair by Sid from ElliottWavePredictions.com. Click on the charts twice to enlarge. The long-term pattern in in the USD/CHF currency pair shows that the August 2011 low was a VERY significant low, essentially ending two terminal Elliott Wave patterns simultaneously. The monthly chart above shows that the 2011 […]

Elliott Wave Analysis of the EUR/USD Currency Pair by Sid from ElliottWavePredictions.com

Elliott Wave Analysis of the EUR/USD Currency Pair by Sid from ElliottWavePredictions.com. Click on the chart twice to enlarge. Beware of being overly bearish the euro right here. The break lower since February 27 could be a false breakout (known in Elliott Wave as wave B of an expanded or running flat). So far, it […]

Quick Update on the EUR/USD Currency Pair by Sid from ElliottWavePredictions.com

Quick Update on the EUR/USD Currency Pair by Sid from ElliottWavePredictions.com. Click on the chart twice to enlarge. The Euro is following the roadmap set out in the previous post nicely. If the main count shown is correct, the Euro will rally early next week, likely through Tuesday, October 23rd. The wave 5 green target […]

Elliott Wave Analysis of the EUR/USD Currency Pair by Sid from ElliottWavePredictions.com

Elliott Wave Analysis of the EUR/USD Currency Pair by Sid from ElliottWavePredictions.com. Click on the chart twice to enlarge. The initial movement down from the August 23 high to the August 28 low in the Euro counts best as a “three”, and the subsequent waves have so far been making lower highs and higher lows. […]

Elliott Wave Analysis of the GBP/USD Currency Pair by Sid from ElliottWavePredictions.com

Elliott Wave Analysis of the GBP/USD Currency Pair by Sid from ElliottWavePredictions.com. Click on the charts twice to enlarge. The British Pound appears likely to be making one last push to the upside. The target zone for the end of the rally that started in mid-January is essentially between 1.625 and 1.63. Once an upward […]