Elliott Wave Hub Event

Another bi-annual Elliott Wave Hub Event is in the books, and Sid Norris was the first presenter of the day, February 13, 2024. During his presentation, Sid offered a glimpse of what we provide subscribers inside our four different levels of service. He also showed his current Elliott Wave counts and associated Fibonacci price targets on the Dow Jones Industrials. Transports, and Utilities, as well as the S&P-500, XLF financials, GDX gold miners, and a Hurst Cycle analysis of the US Dollar Index. The markets are at or near a protentional turning point! A special, limited time offer was also presented for new subscribers.

Quarterly Premium Plan Webinar – January, 2024

Premium Webinar July 2023. Included in tonight’s edition is Sid’s Elliott wave counts on many popular tradable items. Click the link below.

Dow Jones Industrial Average Call – October 29, 2023

Here’s a video clip of the October 29, 2023 webinar, where Sid predicted the 500 point up day in the Dow Jones Industrial Average.

Premium Plan Webinar Recording – October 10, 2023

Premium Webinar July 2023. Included in tonight’s edition is Sid’s Elliott wave counts on many popular tradable items. Click the link below.

Elliott Wave Plus – Premium Plan Webinar Recording – July 20, 2023

Premium Webinar July 2023. Included in tonight’s edition is Sid’s Elliott wave counts on many popular tradable items. Click the link below.

Elliott Wave Hub Presentation – June 27, 2023

During this presentation, Sid showed his current wave counts on the Dow Jones Industrial Average, the S&P-500, Bonds, and Gold.

Elliott Wave Charts – Is Food Inflation Over?

Welcome to a new blog post series entitled, Elliott Wave Charts – Sentiment Conditions! If you want to learn more, please visit ElliottWavePlus.com and visit our Youtube channel.

Premium Webinar April 2023

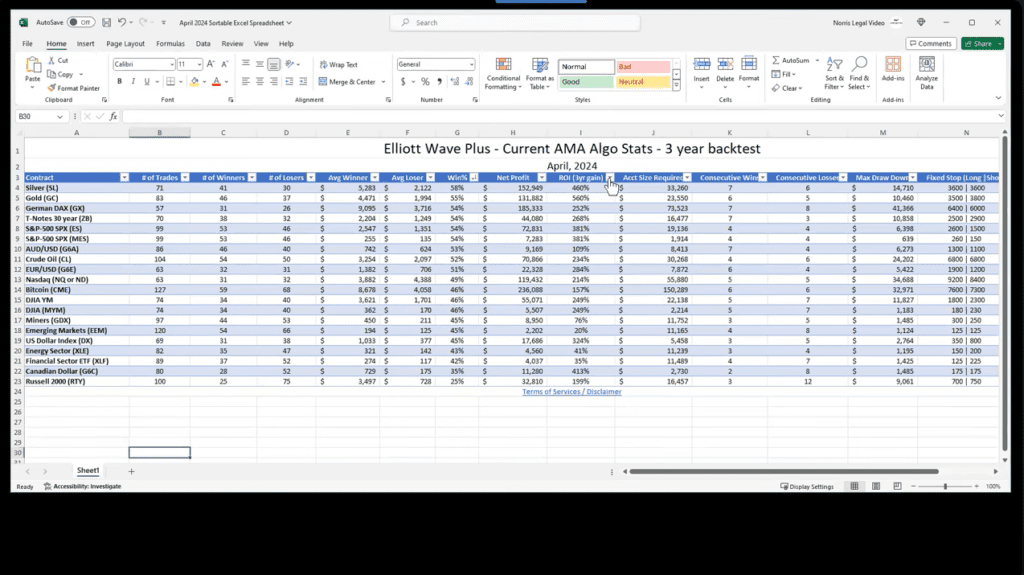

Premium Webinar April 2023. Included in tonight’s edition is the spreadsheet showing the 3-year algo backtest results. Click the link below.

Elliott Wave Hub Presentation

During this presentation, Sid showed his current wave counts on the Dow Jones Industrial Average, the S&P-500, Bonds, and Gold.

Why Our Trading System is Superior to Others

We avoid directional bias by utilizing a combination of dissimilar but robust technical analysis tools and have developed a mix of the specific tools most likely to provide timely trading setups.