More Profitable Algo Trade Signals – KBE

Elliott Wave + Hurst had been projecting upward movement ever since the December 20th low. See how our algo caught this move to the upside.

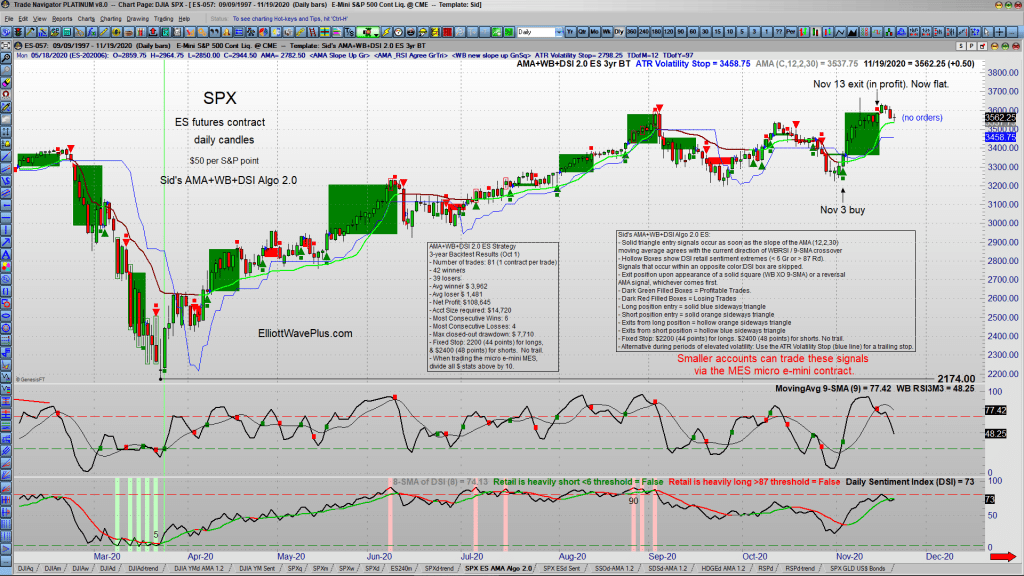

S&P-500 – Almost 500% Return For The Year.

Trend Report. Elliott Wave Trading – Elliott Wave S&P-500 review. How our algo trade signals produced nearly 500% in gains for the year.

Trend Following vs Algo Trading

Every Elliott Wave Plus subscriber receives our trend following charts each night following the close of the U.S stock market. We believe that these trend charts are valuable trading tools, and everyone should be aware of them. But does that make it a perfect system? The short answer is…no.

We take a look at our Daily Trend Report charts in direct comparison to our Nightly Algo trade signals. They might look similar, but the Algo signals have one major advantage. You’ll see why in the video below, which is an excerpt of the previous week’s webinar. Premium Plan subscribers receive the Nightly Algo Report every evening, as well as weekly access to Sid’s Elliott Wave “counts” webinar, bi-weekly screenshots, and the Daily Trend Report.

Sid’s Current Algo Statistics and Results (November 2019 Edition)

By combining robust methods of technical analysis (Hurst cycle analysis, Elliott wave theory and its associated Fibonacci price targets, extreme sentiment positioning, algorithmic trade signals based on momentum, indicator divergences, etc.), our problem-solving power has increased, providing higher confidence trading opportunities.

The September Sortable Algo Spreadsheet

The Results Are In! Over the past couple of years, we have developed algorithms that provide momentum-based trading signals on over 40 items. We publish three-year backtest results of the algo on those 40 items momthly in the form of a sortable, downloadable spreadsheet.