How An Experienced Trader Utilizes Our Analysis in His Trading

How An Experienced Trader Utilizes Our Analysis in His Trading

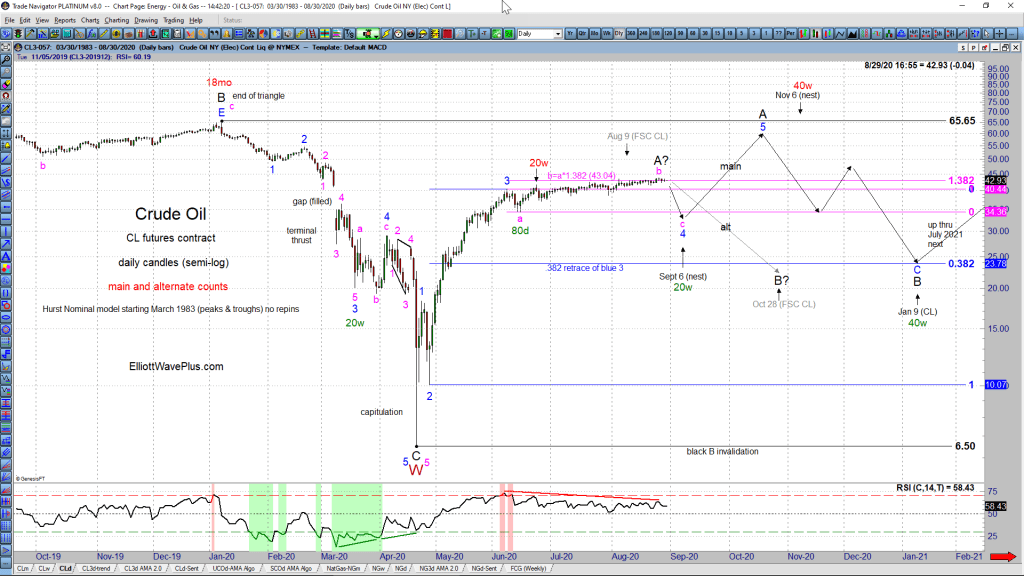

The following trading education document and accompanying chart were provided to us by longtime Premium Plan subscriber “William” yesterday. William is a highly experienced and learned trader, and a multi-decade student of the methods of Larry Williams, Tom DeMark, and others.

Thank You New Email Subscribers! Here’s More Info About Our Paid Subscription Coverage

Thank You New Email Subscribers! Here’s More Info About Our Paid Subscription Coverage

Thank you for signing up for Elliott Wave Plus emails! We try to keep subscribers up to date on what’s going on here at ElliottWavePlus.com without flooding your inbox. Today we would like to show you an inside look at the Pro Plan and Premium Plan subscriptions. As a thank you, we will throw in some bonus material on Crypto currencies, specifically Bitcoin’s Elliott Wave roadmap – a $25 value.

Quarterly Premium Plan Webinar | Free Bonus Content

Every quarter here at ElliottWavePlus.com, we hold a live “Premium-Plan” Webinar, and invite all of our paying subscribers at all levels. The purpose of the webinar is to educate subscribers on the vast array of information provided at all subscription levels. During this (April 7, 2020) webinar, we explained the Nightly Algo Report, and revealed the most current optimized (3-year) backtest settings and results associated with our proprietary momentum algo, in downloadable excel format.

Thoughts on the Current State of the Stock Market (and other stuff) – A blog post by Sid Norris from ElliottWavePlus.com

Without further ado, here are the current combined Hurst projections on several items of interest:

1) US Stock Market: a major top in late 2017 is expected, to be followed by an ABC correction through the year 2024. (And no, I haven’t called the top yet like those super blogging, email blasting, google search manipulators! (-:) From an Elliott Wave perspective, the 5-wave impulse up from the March 2009 low is likely to end soon, though. That bull market will have lasted about 8.5 years, so even if the 2009-2017 bull was a very bullish cycle-degree wave 1 (my main count), a multi-year (cycle-degree) correction would be next.

Quick Update on Crude Oil from Sid at ElliottWavePredictions.com

Quick Update on Crude Oil from Sid at ElliottWavePredictions.com. Click on the chart to enlarge. The combination of Hurst cycle analysis and Elliott Wave is suggesting that the recent bullish period for crude oil has likely come to an end. A Hurst analysis starting at the 2008 high suggests that oil has topped, and will […]

Sid’s latest call is working well! (Long Crude Oil out of a 20-week Hurst cycle trough, from a major Fibonacci target)

Following a highly successful long gold (and gold miners) call in late May, and then a call for a good-sized rally in US equities out of the post-Brexit vote low in late June, Sid Norris from ElliottWavePredictions.com suggested to paid subscribers that crude oil was due for a large bounce starting as early as late July. […]

Elliott Wave Analysis of Oil (QM futures contract) by Sid from ElliottWavePredictions.com

Elliott Wave Analysis of Oil (QM futures contract) by Sid from ElliottWavePredictions.com. Click on the Chart twice to enlarge. Oil may have just finished a blue wave 4 triangle, and if it did, Oil will be shooting to the upside aggressively for probably the next couple of weeks at least. If an upward thrust from […]

Elliott Wave Analysis of the CBOE Oil Index (VIO) by Sid from ElliottWavePredictions.com

Elliott Wave Analysis of the CBOE Oil Index (VIO) by Sid from ElliottWavePredictions.com. Click on the chart twice to enlarge. Here’s a chart of CBOE Oil, an index of the 15 largest integrated oil companies. It shows how oil stocks have taken off to the upside as a direct result of QE4. A quick check […]