Accurate Predictive Technical Analysis

Elliott Wave Plus continues its hot streak when it comes to technical analysis and future roadmaps on multiple stocks and sectors.

Are Interest Rates Topping? Has Inflation Peaked?

The following video clip from our April 10, 2022 Weekly Counts Webinar provide timely food for thought on those two questions. Possible conclusions are based on Elliott wave theory and its associated Fibonacci price targets, multi-decades trendlines (on semilog charts), and current sentiment conditions.

Rising Interest Rates and Inflation are all over the news. Conventional expectations of the directional market reactions to news have been consistently wrong. Investors are confused and worried. It’s time to get technical.

Technical analysis eliminates the worry and confusion. It ignores mainstream financial media, and their ridiculous, news-based explanations of why the market moves up and down. Elliott Wave theory, Cycle analysis and Sentiment Conditions are more important to traders and investors now than ever before.

The attached video clip was recorded on Sunday, April 12, and was a small portion of Sid’s Weekly Counts Webinar for ElliottWavePlus.com subscribers (Pro Plan and up).

In the video, Sid Norris examines TNX (bond yields), and TIP (Treasury Inflation Protection bonds). Are rates going to continue to skyrocket unabated? Is the aggressive inflationary period over?

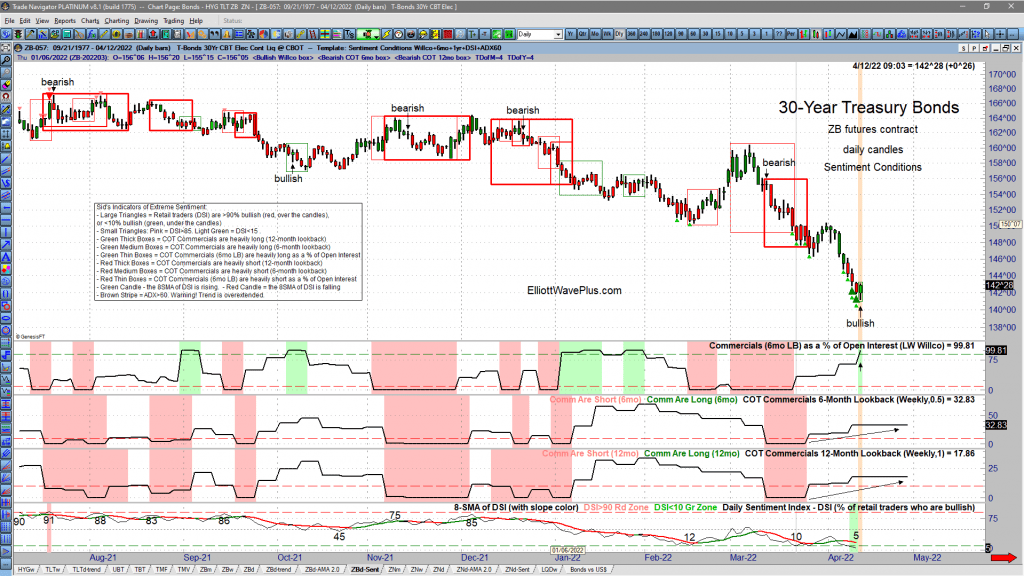

Additional evidence of Sentiment extremes in bonds were presented later in the webinar. Here are current screenshots of current Sentiment Conditions in the ZB contract (30yr bonds), the ZN contract (10yr bonds), and the Japanese Yen, which is historically highly correlated with bonds. These screenshots show that Commercials are expecting rates to top about now (and bonds bottom), while retail traders, who are almost always wrongly positioned at major trend changes, think that rates will continue to aggressively rise. Premium Plan subscribers receive Sentiment Conditions screenshots on many tradable items nightly.

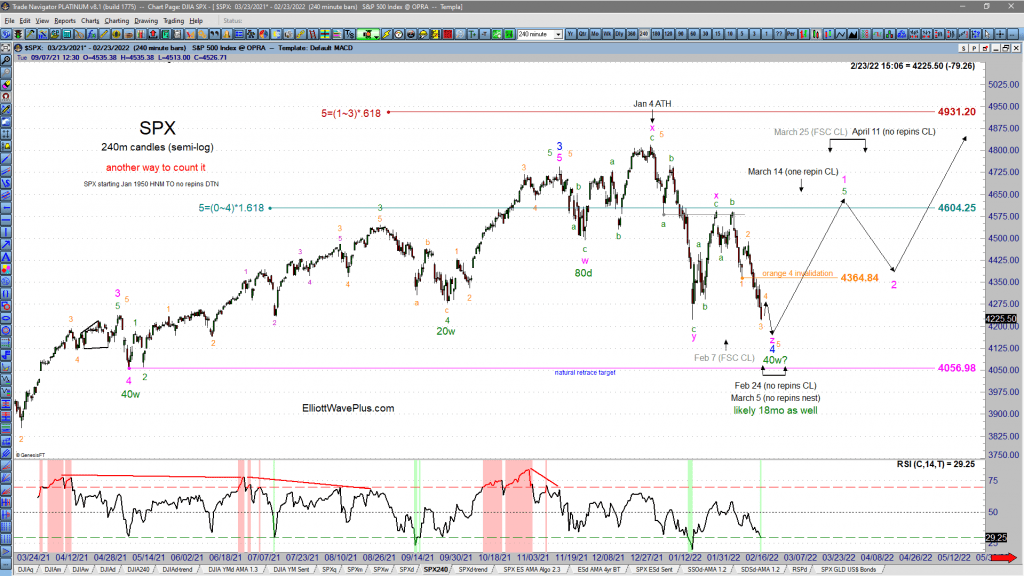

Every Wednesday and Sunday, we provide EWP Screenshots to subscribers (Basic Plan and up) on over two dozen popular trading instruments. The following are the last nine of those for the S&P-500, starting Feb 23, 2022, the day before the first shots were fired in the Russia – Ukraine war:

How Accurate has Elliott Wave Plus been on the S&P-500 recently?

How accurate has Elliot Wave Plus been on the S&P-500 Recently?

Here are our nine most recent EWP Screenshots of Sid’s predictive roadmaps for the S&P-500

Every Wednesday and Sunday, we provide EWP Screenshots to subscribers (Basic Plan and up) on over two dozen popular trading instruments. The following are the last nine of those for the S&P-500, starting Feb 23, 2022, the day before the first shots were fired in the Russia – Ukraine war:

More Profitable Algo Trade Signals – KBE

Elliott Wave + Hurst had been projecting upward movement ever since the December 20th low. See how our algo caught this move to the upside.

Elliott Wave Plus | XLE Precision Timing

Elliott Wave Plus | XLE Precision Timing | A 55% gain in 29 trading days. For more technical analsysis visit ElliottWavePlus.com

S&P-500 – Almost 500% Return For The Year.

Trend Report. Elliott Wave Trading – Elliott Wave S&P-500 review. How our algo trade signals produced nearly 500% in gains for the year.

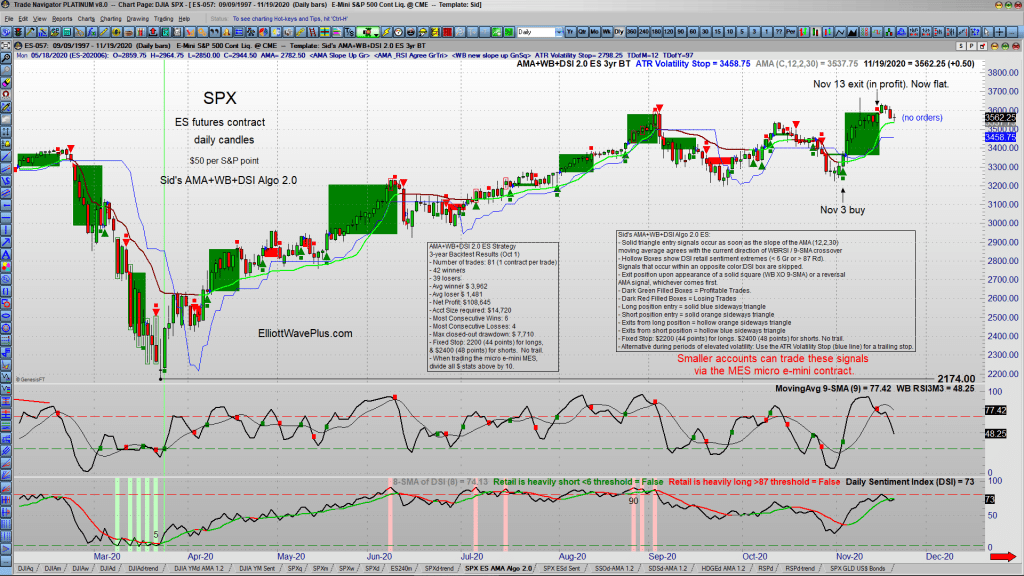

Trend Following vs Algo Trading

Every Elliott Wave Plus subscriber receives our trend following charts each night following the close of the U.S stock market. We believe that these trend charts are valuable trading tools, and everyone should be aware of them. But does that make it a perfect system? The short answer is…no.

We take a look at our Daily Trend Report charts in direct comparison to our Nightly Algo trade signals. They might look similar, but the Algo signals have one major advantage. You’ll see why in the video below, which is an excerpt of the previous week’s webinar. Premium Plan subscribers receive the Nightly Algo Report every evening, as well as weekly access to Sid’s Elliott Wave “counts” webinar, bi-weekly screenshots, and the Daily Trend Report.

Trading Using Elliott Wave – Technical Analysis on Baltic Dry Index – Shipping Sector

Elliott Wave Plus took a deeper look at Baltic Dry Index during the November 8, 2020 weekly-webinar. Pro Plan subscribers were pleased to see an immediate jump, specifically in the shipping sector just one day after the webinar. Check out the excerpt below. Be sure to subscribe for more in-depth technical analysis. Below is a list of items routinely covered by ElliottWavePlus.com. Check out our other resources on educational Elliott Wave trading.