What’s Next for the US Dollar? (by Sid Norris of ElliottWavePlus.com)

The US Dollar has been quite weak since the beginning of last year. Will it continue to weaken? The monthly chart below shows my long-time main Elliott Wave count for the US Index, an unfinished ending contracting diagonal starting at the 1985 high. This wave count correctly expected the US Dollar to top near a .618 retacement of the downward wave from July 2001 through March 2008. That top came in early January 2017, and the Dollar has surprised many by moving strongly lower ever since. Hurst cycle analysis also correctly projected that top, and from a long-term perspective is quite bearish the Dollar moving forward, potentially all the way to the year 2027.

An Important Large-Cap Gold-Mining Stock (ABX) is Still Searching for a Bottom

Gold, Silver and Platinum were up big again on a “Fed” day yesterday, a recurring motif in recent quarters. Yesterday’s bounce was fairly large, especially in many of the large and mid-cap precious metals mining stocks. I’ve been projecting for a long time that a large cycle trough was due near year-end 2017, so is the bottom in on precious metals or not? Let’s take a look.

Precious Metals and Mining Stocks Were Up Big Yesterday. Is the Bottom “In”?

Gold, Silver and Platinum were up big again on a “Fed” day yesterday, a recurring motif in recent quarters. Yesterday’s bounce was fairly large, especially in many of the large and mid-cap precious metals mining stocks. I’ve been projecting for a long time that a large cycle trough was due near year-end 2017, so is the bottom in on precious metals or not? Let’s take a look.

Thoughts on the Current State of the Stock Market (and other stuff) – A blog post by Sid Norris from ElliottWavePlus.com

Without further ado, here are the current combined Hurst projections on several items of interest:

1) US Stock Market: a major top in late 2017 is expected, to be followed by an ABC correction through the year 2024. (And no, I haven’t called the top yet like those super blogging, email blasting, google search manipulators! (-:) From an Elliott Wave perspective, the 5-wave impulse up from the March 2009 low is likely to end soon, though. That bull market will have lasted about 8.5 years, so even if the 2009-2017 bull was a very bullish cycle-degree wave 1 (my main count), a multi-year (cycle-degree) correction would be next.

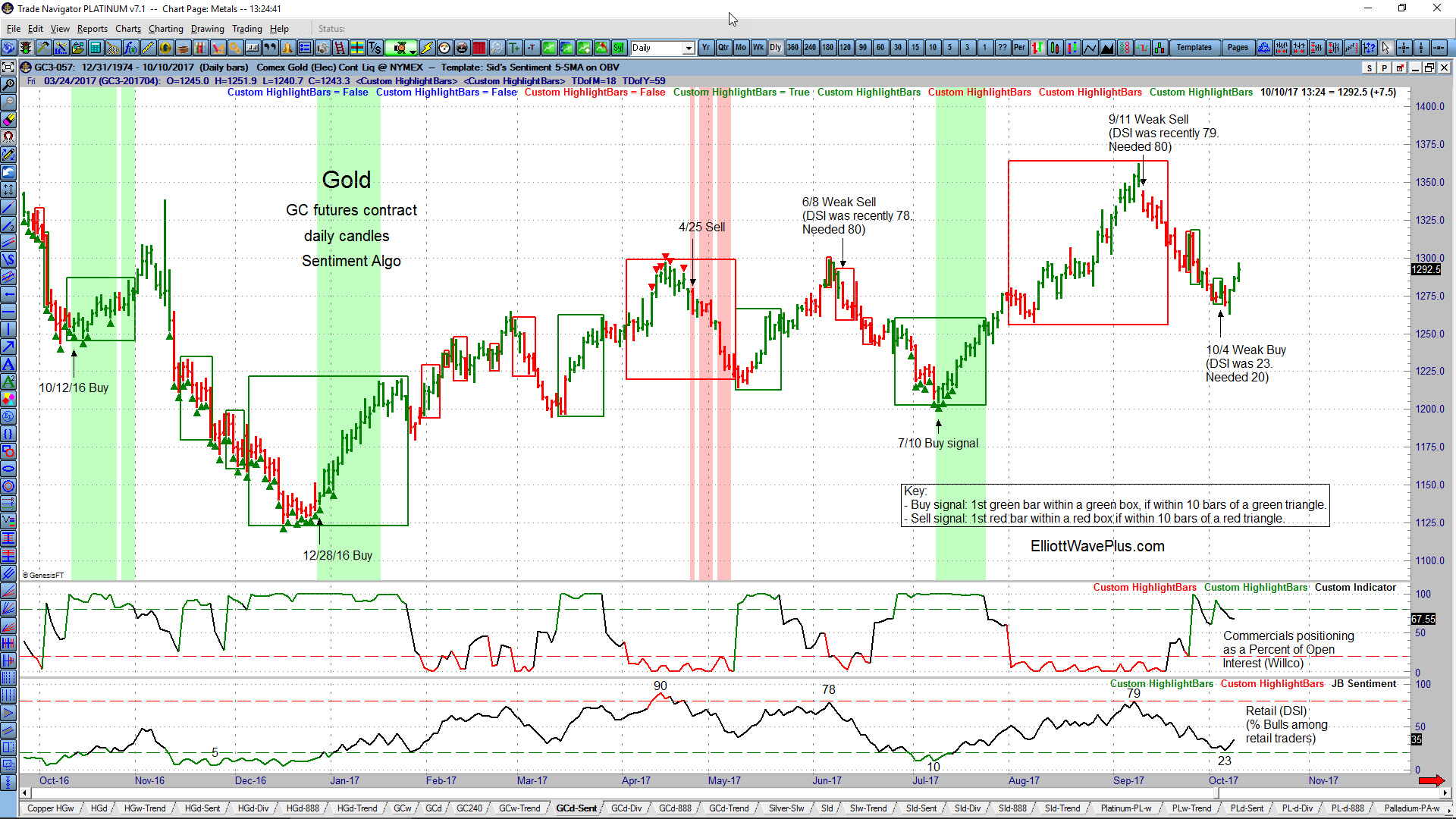

Sid’s Sentiment Algo. How and Why it Works.

In the following video, Sid Norris of Elliott Wave Plus shows the latest revision of his Sentiment Algo, how it was constructed, and how well it has marked several trend changes in the S&P-500 and Gold over the past year.

Did a 9-yr cycle trough just occur in the NZD/USD currency pair?

Did a 9-yr cycle trough just occur in the NZD/USD currency pair? I’ve been tracking the NZD/USD currency pair using both the Hurst nominal model and the gold 7.4-yr model for quite some time now. One would think that this pair would work nicely with the 7.4-yr gold model, since gold and the down-under currency […]

Sid’s Highly Accurate Call on GDX during the April 4, 2017 Weekly “Counts” Webinar

Each week, Sid Norris of ElliottWavePlus.com holds a Sunday webinar for “Pro Plan” subscribers. During the session, he presents his Elliott Wave counts and associated Fibonacci price targets for many of the world’s major stock markets, commodities, currencies, and bonds. Hurst cycle analysis and retail trader sentiment are also strongly considered. Screenshots of all the […]

What’s Up With Gold?

[vc_row][vc_column][vc_column_text title=”What’s Up With Gold?”]Gold has certainly seen an interesting 2016! From December 3, 2015 to July 6, 2016 gold rallied 30% (from $1061.80 to $1388.50). Since that mid-year high, gold has fallen back to $1158.60 as of this morning, December 5, 2016, a drop of about 16%. Let’s take a look at the technical […]

Video Highlight from Sid’s May 29, 2016 “Counts” Webinar – featuring GDX

The following is a two-minute video clip highlight from my May 29, 2016 “Counts” Webinar. This clip features coverage of GDX. Please join me for my Weekly “Counts” Webinar, where I go over all of my Elliott Wave counts and associated Fibonacci price targets for many of the world’s major stocks markets, commodities, currencies, and […]

Elliott Wave Update on Gold and Gold Miners (GDX) from Sid at ElliottWavePredictions.com

Elliott Wave Update on Gold and Gold Miners (GDX) from Sid at ElliottWavePredictions.com. Click on the charts to enlarge. GDX moved to slight new lows today, but the larger picture is unchanged. A large 18-month cycle trough is imminent in gold miners, and Gold and Silver appear to have already shown five small-degree waves up […]