Elliott Wave Plus | XLE Precision Timing

Elliott Wave Plus | XLE Precision Timing | A 55% gain in 29 trading days. For more technical analsysis visit ElliottWavePlus.com

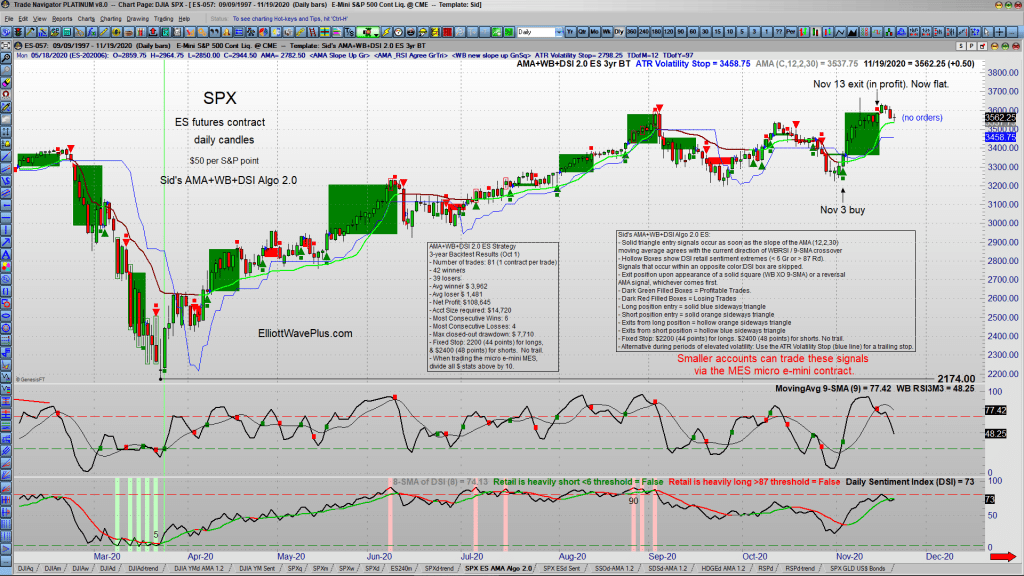

S&P-500 – Almost 500% Return For The Year.

Trend Report. Elliott Wave Trading – Elliott Wave S&P-500 review. How our algo trade signals produced nearly 500% in gains for the year.

Trading Using Elliott Wave – Technical Analysis on Baltic Dry Index – Shipping Sector

Elliott Wave Plus took a deeper look at Baltic Dry Index during the November 8, 2020 weekly-webinar. Pro Plan subscribers were pleased to see an immediate jump, specifically in the shipping sector just one day after the webinar. Check out the excerpt below. Be sure to subscribe for more in-depth technical analysis. Below is a list of items routinely covered by ElliottWavePlus.com. Check out our other resources on educational Elliott Wave trading.

Quarterly Premium Plan Webinar – October 2020 | A Look at our Algo Signals

We have reoptimized our algo trade signals! Every quarter, we record a webinar that gives everyone an inside look at our Premium Plan Nightly Algo Report, which includes nightly conditions on dozens of tradable items. The link below will allow you to download our algo-stats sortable Excel spreadsheet so you can see the backtest and optimization results for yourself. All aspects of the Premium Plan are covered in the webinar recording, and Sid adds additional detail about current market conditions, important future trading dates, and much more. Check out the video and feel free to forward this to anyone who might be interested in receiving the Nightly Algo Report.

Quarterly Premium Plan Webinar – July 2020 | A Free Look at our New Algos

Every quarter, we here at ElliottWavePlus.com record a webinar that gives an in depth look at our Premium Plan Nightly Algo Report, which includes nightly conditions on dozens of tradable items. We’ve been particularly excited about the July webinar because the re-optimized 3-year backtest on our algorithms have improved results across the board, as long as slightly larger stops than normal are used to accommodate the generally elevated VIX levels of 2020. A link below will allow you to download our algo-stats sortable Excel spreadsheet so you can see the backtest and optimization results for yourself. All aspects of the Premium Plan are covered in the webinar recording, and Sid adds additional detail about current market conditions, important future trading dates, and much more. Check out the video and feel free to forward this to anyone who might be interested in receiving the Nightly Algo Report. Thank you and happy trading!

Exciting New Improvements to our Premium Plan Algos for Subscribers

We want to keep our most valued subscribers up to date on what is going on behind the scenes here at ElliottWavePlus.com. We are currently re-optimizing the Nightly Report’s algo trade signals to the most current 3-year backtest (6/30/17 thru 6/30/20). Initial backtesting and optimization indicates that the algos generally need to utilize larger stop-losses during recent high volatility. Our combined Elliott Wave and Hurst Cycle roadmaps suggest that higher volatility will continue to be the norm moving forward. We will be holding the Quarterly Premium Plan webinar within a few days to showcase the results of our backtests and re-optimizations. The results after utilizing larger stops thus far have been very positive and are likely to improve future automated trade signal results. We are working feverishly day and night to finish updating the algos, and should be ready for the quarterly Premium/Crypto Plan webinar very soon. Here are a couple of examples of before/after charts.

Thank You New Email Subscribers! Here’s More Info About Our Paid Subscription Coverage

Thank You New Email Subscribers! Here’s More Info About Our Paid Subscription Coverage

Thank you for signing up for Elliott Wave Plus emails! We try to keep subscribers up to date on what’s going on here at ElliottWavePlus.com without flooding your inbox. Today we would like to show you an inside look at the Pro Plan and Premium Plan subscriptions. As a thank you, we will throw in some bonus material on Crypto currencies, specifically Bitcoin’s Elliott Wave roadmap – a $25 value.

Elliott Wave Plus Informed Subscribers on Friday Morning of an Imminent Up Move in the Stock Market This Week

Elliott Wave Plus Informed Subscribers on Friday Morning of an Imminent Up Move in the Stock Market This Week

As we were headed into the weekend last week (Friday, May 15), many Elliotticians and market forecasting services were content holding on to their bearish positions regarding the stock market, and specifically the S&P-500. The Fed had previously stated that more measures were likely going to be needed to pull the economy out of its current downturn, Buffett was selling off millions of dollars of shares, and talk of major department stores filing for bankruptcy flooded the news. All of which made a very bearish outlook to almost every market forecaster . . . except from us.

Quarterly Premium Plan Webinar | Free Bonus Content

Every quarter here at ElliottWavePlus.com, we hold a live “Premium-Plan” Webinar, and invite all of our paying subscribers at all levels. The purpose of the webinar is to educate subscribers on the vast array of information provided at all subscription levels. During this (April 7, 2020) webinar, we explained the Nightly Algo Report, and revealed the most current optimized (3-year) backtest settings and results associated with our proprietary momentum algo, in downloadable excel format.

Who Could Have Predicted This Huge Down Move In The Market?

On November 15, 2019, the S&P-500 reached 3120 for the first time ever. For the next 63 trading days, the S&P continued relentlessly higher, topping on Feb 19 at 3393. Just four days later, the S&P was back down to 3120, almost instantly erasing three full months of gains! Nobody could have seen that coming ahead of time, could they? We know of at least one person who did.