Elliott Wave Hub Event

Another bi-annual Elliott Wave Hub Event is in the books, and Sid Norris was the first presenter of the day, February 13, 2024. During his presentation, Sid offered a glimpse of what we provide subscribers inside our four different levels of service. He also showed his current Elliott Wave counts and associated Fibonacci price targets on the Dow Jones Industrials. Transports, and Utilities, as well as the S&P-500, XLF financials, GDX gold miners, and a Hurst Cycle analysis of the US Dollar Index. The markets are at or near a protentional turning point! A special, limited time offer was also presented for new subscribers.

Elliott Wave Hub Presentation – June 27, 2023

During this presentation, Sid showed his current wave counts on the Dow Jones Industrial Average, the S&P-500, Bonds, and Gold.

Elliott Wave Hub Presentation

During this presentation, Sid showed his current wave counts on the Dow Jones Industrial Average, the S&P-500, Bonds, and Gold.

Why Our Trading System is Superior to Others

We avoid directional bias by utilizing a combination of dissimilar but robust technical analysis tools and have developed a mix of the specific tools most likely to provide timely trading setups.

The Stock Market is Entering 2023 at a Critical Juncture

The Stock Market Is Entering 2023 At A Critical Juncture

Summary

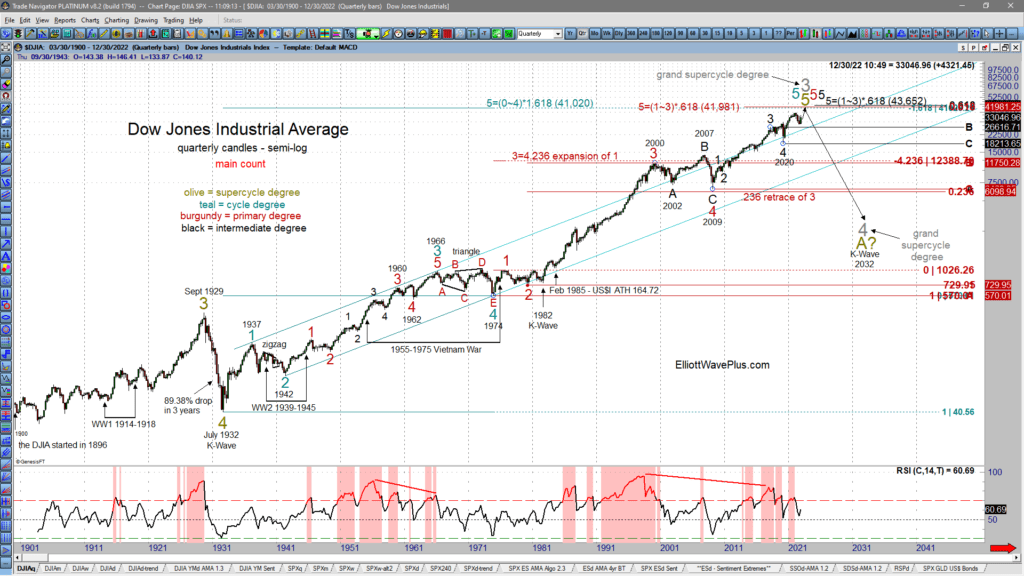

There is a cluster of three large-degree Fibonacci targets that suggest that the Dow Jones Industrial Average has not completed 5-waves up from the 1932, 1974 & 2009 lows yet.

The March 2020 low was an intermediate-degree (black) wave 4 low. There are two potential ways the market can finish a 5-wave structure up from that low.

Shorter-term, I’ve been tracking three potential wave counts for the S&P-500. The market could eliminate up to two of those counts during the first few weeks of the new year.

Our method of combining Elliott wave and its associated Fibonacci price targets, Hurst cycle analysis, sentiment extremes, momentum, volume signatures and more provide higher confidence trading forecasts than Elliott wave theory when used alone.

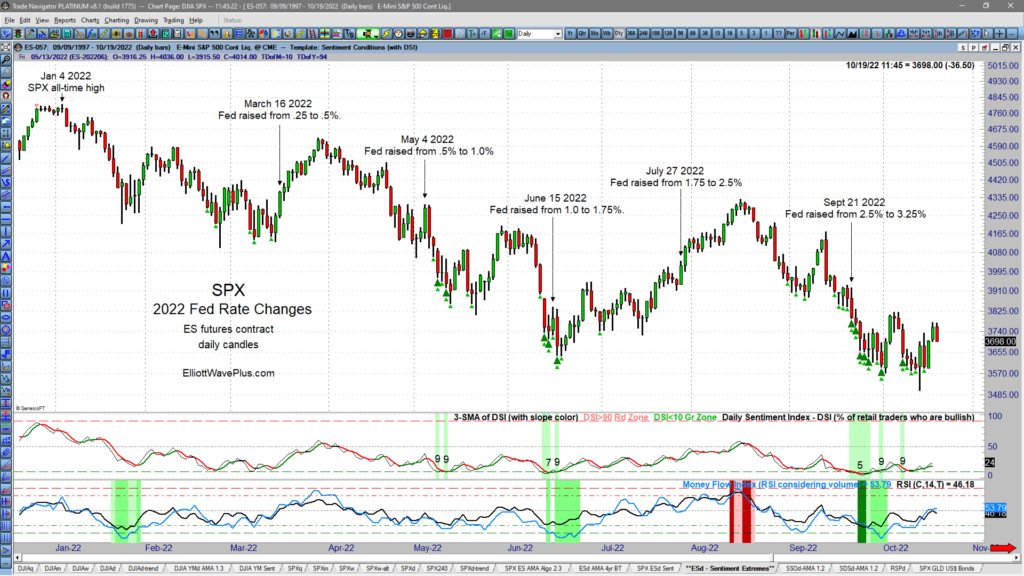

What’s Driving the Markets this Year?

What’s been driving the markets this year? If your market research consists primarily of watching financial television channels, you’d swear that the Fed must be controlling all market movements like it was a puppet master! The vast majority of TV pundits will answer questions about where the market is going next with at least some mention of the Fed. Let’s look at all the Fed’s rate changes so far this year to see if they are producing consistent buy or sell signals for investors and traders.

How to Utilize Elliott Wave Plus

Welcome to the October 2022 Quarterly Premium Plan Webinar. These quarterly events are Elliott Wave Plus’s most anticipated events. Our current subscribers find these recording extremely useful, as do our free visitors at ElliottWavePlus.com. This video and blog will show how to best utilize our service offerings here at Elliott Wave Plus and will help new subscribers decide which subscription tier is right for them.

Quarterly Premium Plan Webinar and Sortable Spreadsheet – Aug 4, 2022

We believe our sentiment condition screenshots are so amazingly valuable to traders, we wanted to spend some time showing viewers how to read those charts, and how to utilize them in your trading. These charts show DSI (retail positioning), and multiple measures of commercials (the producers/hedgers) positioning. As we all know, retail traders are notoriously positioned on the wrong side of trade at major turns. Knowing retail vs commercial is crucial when timing your trades.

Are Interest Rates Topping? Has Inflation Peaked?

The following video clip from our April 10, 2022 Weekly Counts Webinar provide timely food for thought on those two questions. Possible conclusions are based on Elliott wave theory and its associated Fibonacci price targets, multi-decades trendlines (on semilog charts), and current sentiment conditions.

Rising Interest Rates and Inflation are all over the news. Conventional expectations of the directional market reactions to news have been consistently wrong. Investors are confused and worried. It’s time to get technical.

Technical analysis eliminates the worry and confusion. It ignores mainstream financial media, and their ridiculous, news-based explanations of why the market moves up and down. Elliott Wave theory, Cycle analysis and Sentiment Conditions are more important to traders and investors now than ever before.

The attached video clip was recorded on Sunday, April 12, and was a small portion of Sid’s Weekly Counts Webinar for ElliottWavePlus.com subscribers (Pro Plan and up).

In the video, Sid Norris examines TNX (bond yields), and TIP (Treasury Inflation Protection bonds). Are rates going to continue to skyrocket unabated? Is the aggressive inflationary period over?

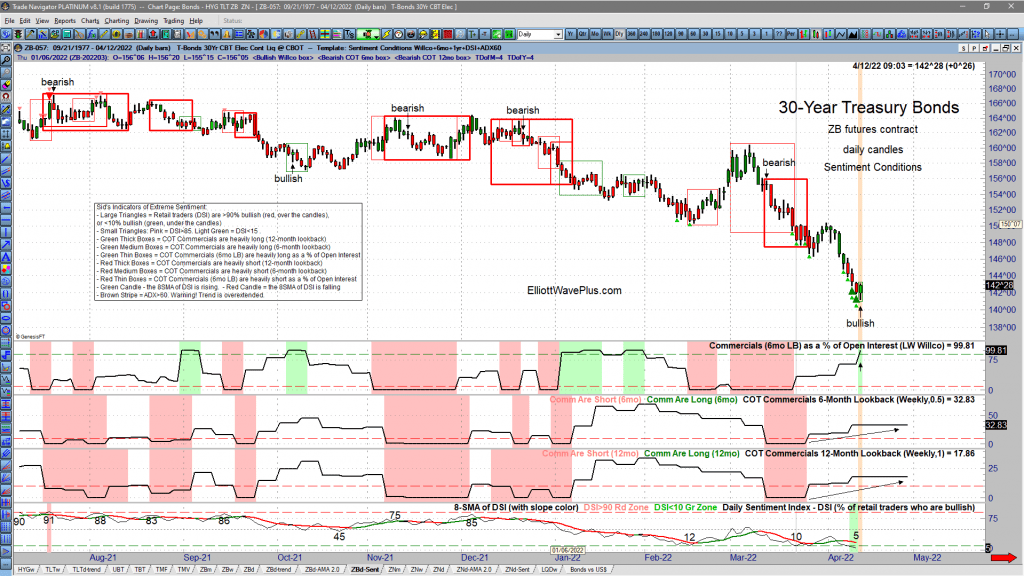

Additional evidence of Sentiment extremes in bonds were presented later in the webinar. Here are current screenshots of current Sentiment Conditions in the ZB contract (30yr bonds), the ZN contract (10yr bonds), and the Japanese Yen, which is historically highly correlated with bonds. These screenshots show that Commercials are expecting rates to top about now (and bonds bottom), while retail traders, who are almost always wrongly positioned at major trend changes, think that rates will continue to aggressively rise. Premium Plan subscribers receive Sentiment Conditions screenshots on many tradable items nightly.

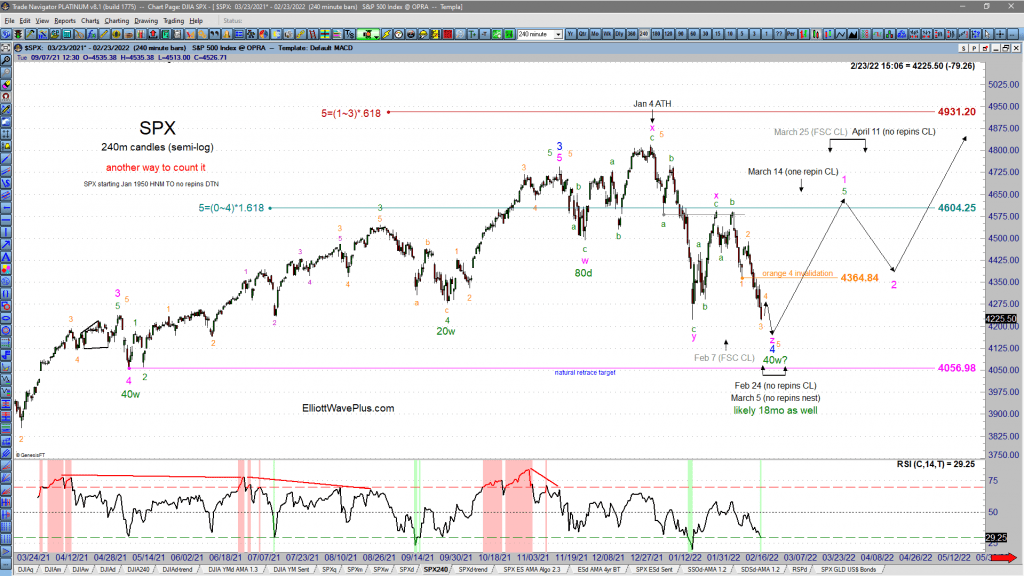

Every Wednesday and Sunday, we provide EWP Screenshots to subscribers (Basic Plan and up) on over two dozen popular trading instruments. The following are the last nine of those for the S&P-500, starting Feb 23, 2022, the day before the first shots were fired in the Russia – Ukraine war:

How Accurate has Elliott Wave Plus been on the S&P-500 recently?

How accurate has Elliot Wave Plus been on the S&P-500 Recently?

Here are our nine most recent EWP Screenshots of Sid’s predictive roadmaps for the S&P-500

Every Wednesday and Sunday, we provide EWP Screenshots to subscribers (Basic Plan and up) on over two dozen popular trading instruments. The following are the last nine of those for the S&P-500, starting Feb 23, 2022, the day before the first shots were fired in the Russia – Ukraine war: