Sid’s Current Algo Statistics and Results (November 2019 Edition)

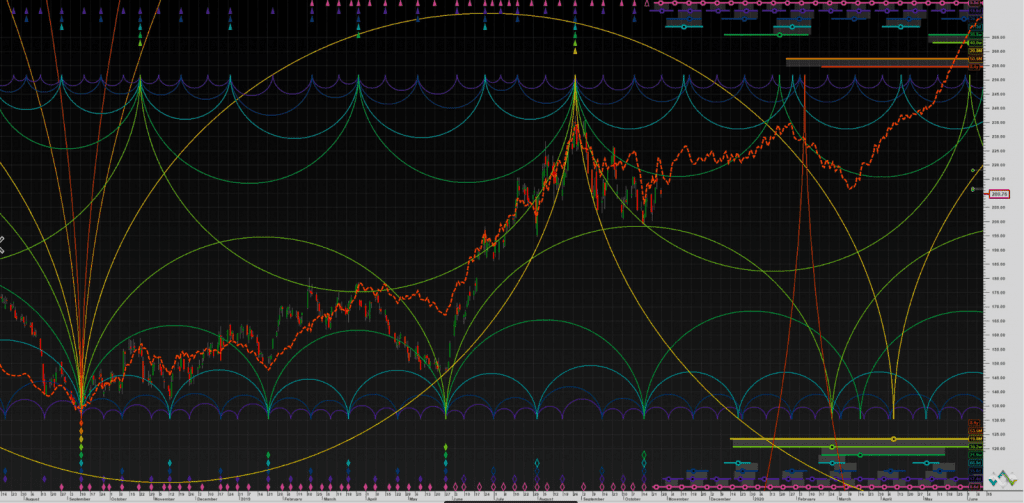

By combining robust methods of technical analysis (Hurst cycle analysis, Elliott wave theory and its associated Fibonacci price targets, extreme sentiment positioning, algorithmic trade signals based on momentum, indicator divergences, etc.), our problem-solving power has increased, providing higher confidence trading opportunities.

How Hurst Cycle Analysis Improves Our Elliott Wave Counts

By combining robust methods of technical analysis (Hurst cycle analysis, Elliott wave theory and its associated Fibonacci price targets, extreme sentiment positioning, algorithmic trade signals based on momentum, indicator divergences, etc.), our problem-solving power has increased, providing higher confidence trading opportunities.

The September Sortable Algo Spreadsheet

The Results Are In! Over the past couple of years, we have developed algorithms that provide momentum-based trading signals on over 40 items. We publish three-year backtest results of the algo on those 40 items momthly in the form of a sortable, downloadable spreadsheet.

Trading XLE with Precision using Elliott Wave & Hurst Cycle Analysis

During our August 25, 2019 Weekly “Counts” Webinar, I showed that Hurst cycle analysis was suggesting that a rally was imminent in XLE, the large-cap Oil stock ETF, and the rally was expected to continue through mid-September 2019. XLE bottomed on August 27 and rallied over 14% through September 16.

That rally was well underway when the two Saudi Oil installations were bombed by drones on Saturday, September 14. So which method of predicting trend changes was more effective? Technical analysis, or trading the news? The answer is obvious.

Elliott Wave Plus – Testimonials

Lots of glowing testimonials have been pouring in at ElliottWavePlus.com. I wanted to take a minute to thank everyone around the globe who has supported my work. Here’s a video highlighting some of the recent testimonials:

Trading Stocks with Elliott Wave Plus (Subscription Tiers)

At Elliott Wave Plus we utilize multiple methods of technical analysis. Through these methods we can position ourselves in a way that gives us (the retail trader) an advantage over others. With the combination of Elliott Wave, Fibonacci price targets, Hurst Cycle analysis, and advanced volume indicators, we can help remove insecurities and emotions from current trading opportunities. We have a plan for everyone.

Trading AAPL (Apple Stock) with Precision Timing!

During the June 2 weekly webinar, Sid expected an important bottom was imminent for AAPL. That bottom came in the very next day. From there, Sid predicted a push to the upside for the rest of the month. He stated in the weekly webinar that AAPL would reach a top near the end of July. The stock peaked on July 31 and continued to meticulously follow Sid’s Elliott Wave count.

Trading the DOW with Precision Timing!

In late May, Sid projected a road map for the DOW, calling for an early June bottom and a late July top. Check out this video including excerpts from Sid’s June 2 and June 9, 2019 webinars, which included amazingly accurate calls for the recent multi-week swing low and swing high in the DJIA (Dow Jones Industrial Average):

Trading Gold with Precision Timing!

In late May of 2019, while other market forecasting services were suggesting that gold would continue further to the downside, Sid was bullish. Those other forecasters remained bearish until gold broke out above the 2016 high. What good did that do anyone? Now, with gold only about 5% percent above that 2016 high, those other guys are very bearish on gold once again. Why? Because Elliott Wave theory, when used alone, is dangerously subjective. However, when Elliott Wave is combined with a dissimilar but equally robust methodology (like Hurst Cycle Analysis), a different forward roadmap often emerges.

Trading Bitcoin with Precision Timing! (My calls on Bitcoin since late 2017)

In late 2017, the relentless parabolic move to upside in Bitcoin had caught the attention of the entire trading world. Since that time though, market participants have made OR lost a fortune during the one-year-long 84% crash of Bitcoin, depending on whether they were on the right side of the trade or not. The video below shows my analysis and projections for price movement in Bitcoin since late 2017.