Has Silver Delivered An Important Message About Gold? – Gold & Silver Analysis

Gold and Silver are traditionally very highly correlated. When one moves up, the other moves up, and vice versa. They may not move the same percentages, but the directionality is typically identical. During Silver’s recent capitulation move to below 12 cents per ounce, a level last seen in Jan 2009, Gold stayed above 1450. If Silver’s “capitulation” is finished, and that idea is supported by the fact that it has already rallied 28% from that low, why would gold puke out now?

And yet, those “mainstream” Elliotticians continue to be deadly bearish with their Gold wave count because they think they saw five waves down from 2011 thru 2015. The time to consider the possibility that that was not a 5-wave down structure is WAY overdue, don’t you think? Maybe it was a WXY, or WXYXZ structure. That has been my main wave count all along. Why? Hurst Cycle Analysis. My secret weapon.

U.S Dollar Index – Algo Trade Signals and Sentiment Positioning 2020

U.S Dollar Index – Algo Trade Signals and Sentiment Positioning 2020

It’s been another profitable month for our Nightly Algo Report for Premium Plan subscribers here at ElliottWavePlus.com. In this post. we’ll provide an in-depth look at the U.S Dollar Index, and the trade signals that our proprietary momentum algorithm has been producing. Remember, this is just one of twenty popularly traded items covered for our Premium Plan subscribers, who receive screenshots every evening (M-F), along with a summary “check list” PDF. Click here for a complete list of items covered.

Educational Resources Available To Everyone

Here’s a look into the most recent weekly “counts” webinar from ElliottWavePlus.com. During this week’s introduction, Sid talks about many of the free resources available at the site.

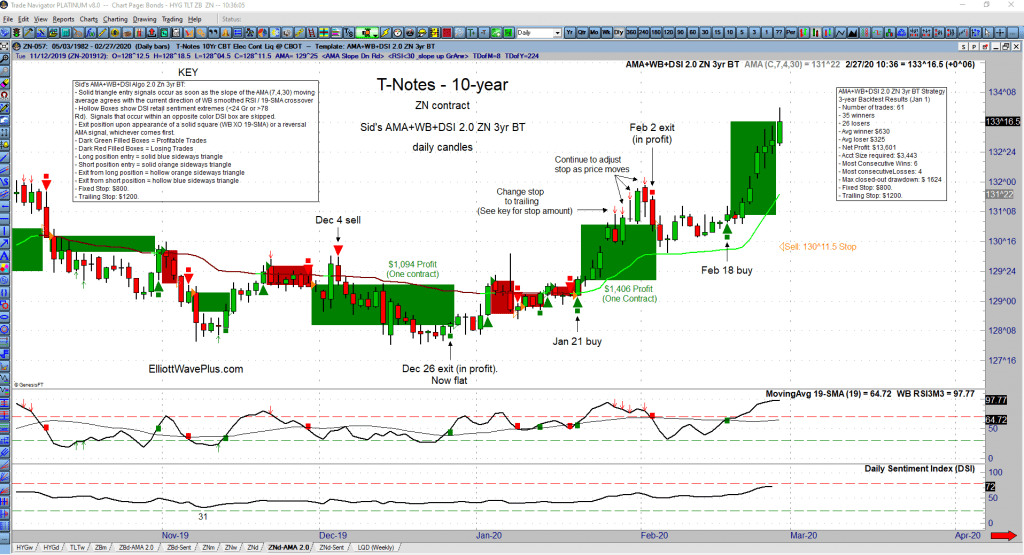

Free In-Depth Look At Our Nightly Algo Report

We’d like to give you a more in depth look at an AMA momentum algo chart that our Premium Plan subscribers received last night, as well as the associated sentiment conditions screenshot and PDF “quick check” summary. All of those items are provided to to Premium Plan subscribers nighty (M-F).

Who Could Have Predicted This Huge Down Move In The Market?

On November 15, 2019, the S&P-500 reached 3120 for the first time ever. For the next 63 trading days, the S&P continued relentlessly higher, topping on Feb 19 at 3393. Just four days later, the S&P was back down to 3120, almost instantly erasing three full months of gains! Nobody could have seen that coming ahead of time, could they? We know of at least one person who did.

Have We Reached An Unsustainable Situation?

Gold & Bonds are typically correlated. As of this writing, that historic relationship appears to be intact. Compare that to Gold & the U.S dollar. Those two items typically move opposite (inverse) of each other. However, since mid-July 2019, they have generally been moving up and down together.

Bonds, which are the most popular alternative to stock ownership in the investment world, typically move opposite of the stock market. However, ever since the start of the new year (2020), stocks, bonds, gold and the US Dollar have all been rallying together. Is this a distortion that has developed because of mid-October 2019 Fed announcement of QE? Many think so. If so however, there was a delayed reaction of 2.5 months.

Is The Stock Market Losing Upward Momentum?

The most publicized stock market indices continue to hover near all-time highs, but is this market losing momentum? The answer is YES. Examine the following multi-timeframe screenshots of the Dow Jones Industrial Average (DJIA) with a standard RSI indicator on the bottom of the screen. The loss of momentum is clearly shown in the form of bearish RSI divergence.

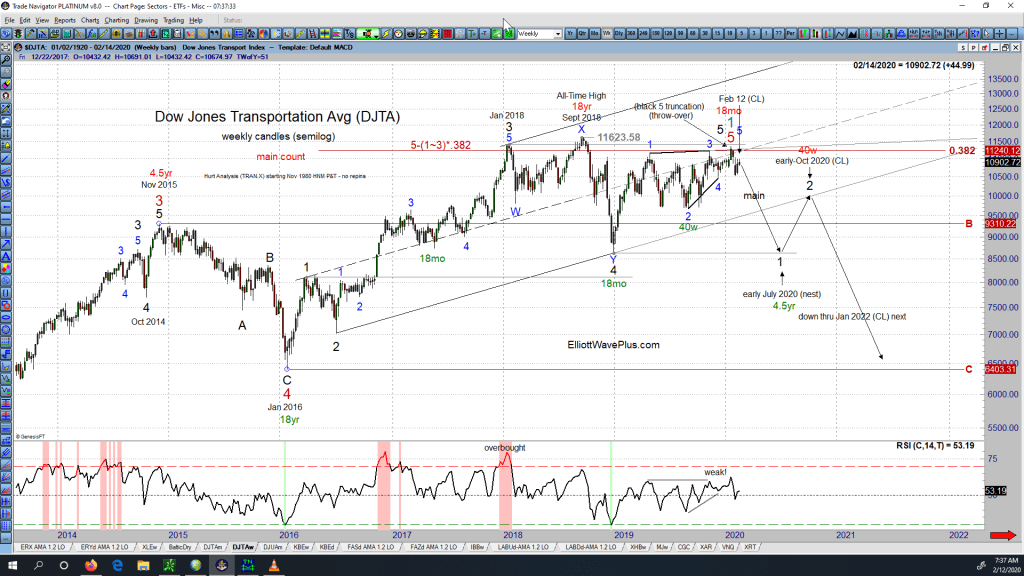

Is a Dow Theory Non-Confirmation In Play?

The original Dow Theory states that the market is in an upward trend if either the industrial or transportation index advances above a previous important high and is accompanied or followed by a similar advance in the other average. For example, if the Dow Jones Industrial Average (DJIA) climbs to a new all-time high, and the Dow Jones Transportation Average (DJTA) follows suit within a reasonable period of time, the upward trend is confirmed.

The Quarterly Premium Plan Webinar

Quarterly Premium Plan Webinar 1-17-20. During this free webinar, we cover multiple topics such as:

The different levels of services offered at ElliottWavePlus.com (Crypto Plan, Basic Plan, Pro Plan, and our Premium Plan), How to navigate within our ElliottWavePlus.com website, Helping yourself to our Resources, Our Blog and how to use it, How to utilize our top-tier service – The Premium Plan.

Sid’s Current Analysis on Gold – January 12, 2020

Sid Norris of ElliottwavePlus.com, during the Sunday, January 12, 2020 weekly “counts” webinar for Pro-Plan subscribers describes his Elliott Wave count and associated Fibonacci price targets on Gold.